Tax Loss Harvesting: A Financial Strategy Worth Your Attention

I want to share how tax loss harvesting can improve your investment performance over time. This strategy might sound complex, but I’ll break it down into practical terms that show its real value for your portfolio.

What Is Tax Loss Harvesting?

Tax loss harvesting is a strategy to reduce your taxes on your portfolio by selling investments that have dropped in value. These realized losses can then offset capital gains in your portfolio and up to $3,000 of ordinary income annually.

Here’s what makes it powerful: you don’t need to change your overall investment strategy. After selling the losing position, you immediately purchase a similar (but not identical) investment to maintain your market exposure. This allows you to capture tax benefits while staying invested according to your plan.

The Research-Backed Value of Tax Loss Harvesting

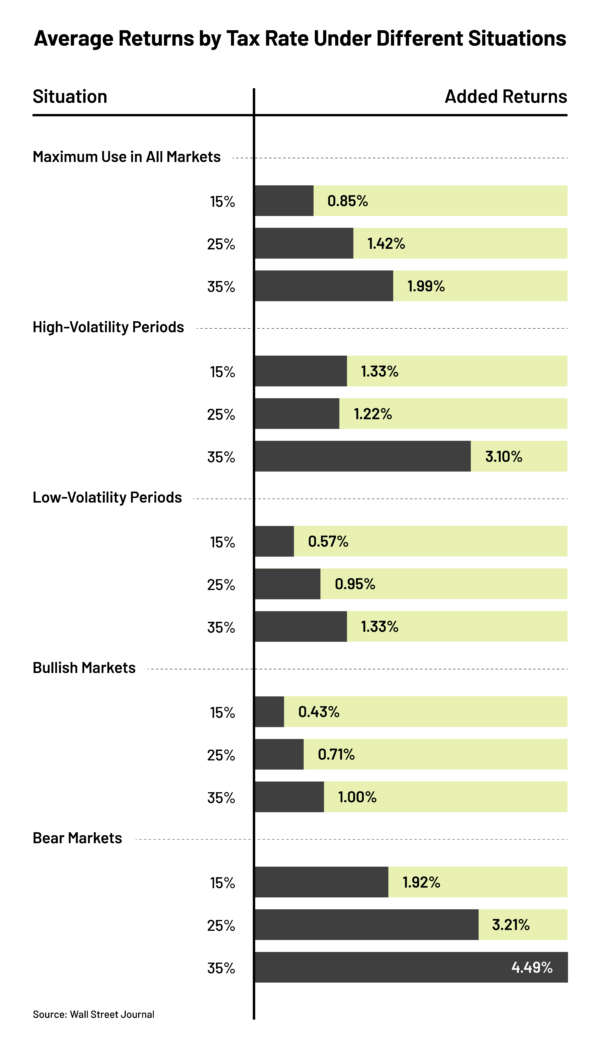

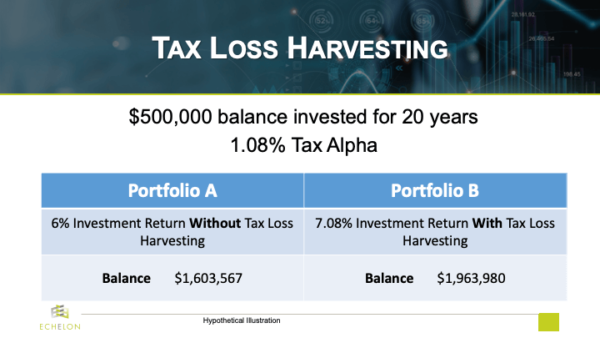

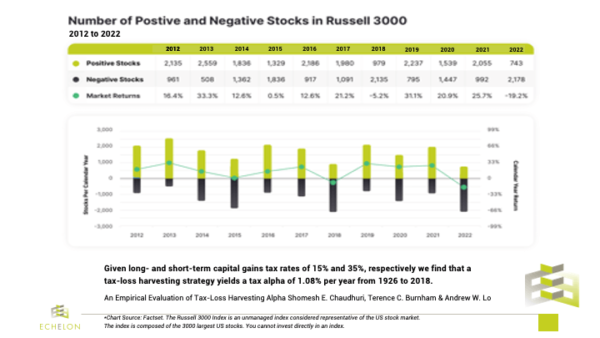

A significant study by Shomesh E. Chaudhuri, Terence C. Burnham, and Andrew W. Lo titled “An Empirical Evaluation of Tax-Loss Harvesting Alpha” provides concrete evidence of this strategy’s effectiveness. Their research shows that systematic tax loss harvesting can add approximately 1.10% in additional annual after-tax returns for typical investors.

This extra return—called “tax alpha”—compounds dramatically over time. A 1% annual improvement might seem modest, but it can potentially increase your portfolio value by 25-50% over 30 years, depending on your tax situation and investment approach.

How Tax Loss Harvesting Works in Practice

Let me walk you through a practical example:

Imagine you purchased 100 shares of a technology ETF at $10,000 ($100 per share). Its value has fallen to $8,000 ($80 per share). You still believe in this market sector, but:

- You sell all 100 shares, realizing a $2,000 loss

- You immediately purchase a different technology ETF with similar—but not identical—holdings

- Your $2,000 loss can now offset $2,000 in capital gains, potentially saving you $400-$800 in taxes (depending on your tax rate)

- You maintain your market exposure through the similar replacement investment

The money saved on taxes stays in your portfolio, working for you rather than going to the government.

Key Considerations for Effective Implementation

Timing Matters

The research by Chaudhuri and colleagues demonstrates that market volatility creates more tax loss harvesting opportunities. During market downturns, the strategy becomes even more valuable. This makes it a countercyclical strategy that works hardest when markets are challenging.

Their study showed that tax loss harvesting opportunities aren’t evenly distributed throughout the year. The final quarter often presents prime opportunities due to:

- Year-end tax planning

- Seasonal market patterns

- Portfolio rebalancing activity

Watch Out for Wash Sale Rules

The IRS “wash sale rule” prevents claiming a loss if you purchase a “substantially identical” security within 30 days before or after selling at a loss. This is why proper implementation requires careful security selection.

Working with a professional can help you navigate these rules while maintaining your desired market exposure.

Who Benefits Most from Tax Loss Harvesting?

Tax loss harvesting works best for:

- Investors in higher tax brackets (federal rates of 32% or above)

- Portfolios with significant taxable investments (outside IRAs, 401(k)s)

- Investors with substantial capital gains to offset

- Portfolios with diverse individual securities (rather than just a few funds)

The Chaudhuri research shows the strategy provides varying benefits across investor types. They documented improved results for:

- High-income investors (1.42% annual additional return)

- Investors with longer time horizons

- Those with regular portfolio contributions

Real-World Application: Making This Work for You

Starting Considerations

Before implementing tax loss harvesting, we need to evaluate:

- Your current portfolio structure

- Recent gains/losses and carryforward losses

- Your marginal tax rate

- Your investment timeframe

- Portfolio turnover tendencies

Implementation Process

Working together, we would:

- Identify position-by-position loss opportunities across your taxable accounts

- Select appropriate replacement investments that maintain your asset allocation

- Document each transaction for tax reporting

- Track wash sale periods carefully

- Record loss carryforwards for future tax years

Beyond Basic Tax Loss Harvesting

Advanced strategies build on these basics:

- Tax-aware asset location: Placing tax-inefficient investments in tax-advantaged accounts

- Direct indexing: Creating customized baskets of individual stocks rather than funds, allowing for more granular loss harvesting

- Tax-aware rebalancing: Using new cash flows to rebalance rather than selling appreciated positions

The Compounding Effect of Tax Savings

The power of tax loss harvesting comes from keeping more money working in your portfolio over time. The money saved from taxes compounds alongside your other investments, creating a snowball effect.

The Chaudhuri study quantified this impact. For a middle-income investor making regular contributions over 30 years, the cumulative impact translated to approximately 38.6% higher after-tax wealth.

Misconceptions About Tax Loss Harvesting

Several myths about tax loss harvesting need addressing:

Myth 1: “It only delays taxes rather than reducing them.”

While tax deferral is part of the benefit, the strategy offers much more:

- Tax rate arbitrage (offsetting short-term gains taxed at higher rates with losses)

- Step-up in basis at death for inherited assets

- The time value of money (tax dollars saved today can grow for years)

- Potential for offsetting up to $3,000 of ordinary income annually

The Chaudhuri research confirms that the total tax savings exceed mere deferral benefits.

Myth 2: “You need a down market to benefit.”

Even in rising markets, portions of a diversified portfolio typically underperform. Individual stocks, sectors, or geographic regions face temporary declines even during broader bull markets. Professional monitoring can identify these opportunities throughout market cycles.

Myth 3: “The benefits don’t justify the effort.”

For investors with substantial taxable accounts, the research demonstrates that systematic tax loss harvesting’s benefits can outweigh the costs by a significant margin. The Chaudhuri study estimates that even accounting for transaction costs and management fees, the strategy adds meaningful value.

Our Approach

If we decide tax loss harvesting makes sense for your situation, here’s how we’ll implement it:

- Initial Portfolio Analysis: We’ll review your existing holdings, identifying harvesting opportunities and any structural changes needed to maximize future benefits.

- Systematic Monitoring: My team continuously scans your portfolio for loss harvesting opportunities, with increased vigilance during market volatility.

- Strategic Execution: When implementing trades, we balance:

- Size of potential tax benefit

- Transaction costs

- Maintaining desired market exposure

- Minimizing tracking error to your target allocation

- Comprehensive Documentation: We maintain detailed records of all harvested losses and replacement securities for tax reporting and future planning.

- Tax Season Coordination: We work closely with your tax professional to ensure harvested losses are properly reported and utilized.

The Psychology of Tax-Efficient Investing

One often overlooked aspect of tax loss harvesting is its psychological benefit. Market downturns naturally create anxiety for investors. Having a proactive strategy that finds value during these periods can help maintain discipline when emotions might otherwise lead to poor decisions. It is like making lemonade out of lemons,

The Chaudhuri study noted that investors who engaged in systematic tax loss harvesting were less likely to abandon their investment plans during market volatility. This behavioral advantage adds another layer of potential value beyond the direct tax savings.

Case Study: Tax Loss Harvesting in Action

Let’s examine how this strategy worked for one of my clients during a recent market correction:

James is a tech executive with a $2 million taxable portfolio. During a 15% market correction, we identified $180,000 in unrealized losses across several positions. By harvesting these losses while maintaining market exposure through similar but not identical investments, we created:

- $42,840 in tax savings (at his 20% Capital Gains tax rate plus 3.8% NIIT)

- Offset for gains from his company stock options

- Reduction in his overall tax bill

- Psychological benefit of taking positive action during market weakness

When the market recovered six months later, James maintained full exposure to the rebound while keeping the tax savings working in his portfolio.

Integration with Your Overall Financial Plan

Tax loss harvesting works best as part of a comprehensive financial strategy. We’ll integrate it with your:

- Retirement planning

- Estate planning goals

- Cash flow needs

- Other tax minimization strategies

The goal is creating a coordinated approach where each component supports your broader financial objectives.

The Mathematical Advantage Over Time

The power of tax loss harvesting becomes clearer when we examine the mathematics. If we take the Chaudhuri study’s finding of a 1.10% annual improvement for a middle-income investor, we can calculate the impact over various time periods:

- After 10 years: 11% more wealth

- After 20 years: 22% more wealth

- After 30 years: 36% more wealth

This compounding effect makes tax loss harvesting particularly valuable for:

- Young investors with decades ahead

- Those saving for multi-generational goals

- Anyone focused on maximizing long-term wealth

Different Approaches to Implementation

There are several ways to implement tax loss harvesting in your portfolio:

- Traditional Approach

- Manual monitoring of positions

- Using mutual funds or ETFs as replacement vehicles

- Annual or quarterly harvesting schedule

- Direct Indexing Approach

- Creating customized portfolios of individual securities

- More granular loss harvesting opportunities

- Potentially higher tax alpha

- Additional customization possibilities

- Hybrid Approach

- Using direct indexing for core positions

- ETFs for specialized market segments

- Optimized for both tax efficiency and cost management

Each approach has merits depending on your portfolio size, complexity, and objectives. We can discuss which might work best for your situation.

Getting Started with Tax Loss Harvesting

If you’re interested in exploring this strategy for your portfolio, I recommend starting with:

- A thorough review of your current taxable investments

- A look at your recent tax returns to identify capital gain patterns

- Discussion of your investment timeframe and need for portfolio withdrawals

- Consideration of any planned major financial changes in the next 1-3 years

After this assessment, we can determine if tax loss harvesting makes sense for your unique circumstances and design an implementation approach.

Final Thoughts

Tax loss harvesting represents one of the most reliable ways to improve investment returns without increasing risk. The research from Chaudhuri, Burnham, and Lo validates what financial professionals have observed for years—strategic tax management meaningfully impacts long-term wealth creation.

By reducing tax drag on your investments, we put more of your money to work toward your financial goals. While markets will always experience volatility, tax loss harvesting allows us to find opportunity in market downturns.