The Mega Backdoor Roth Strategy: Your Path to Tax-Free Retirement Wealth

Introduction

I’ve guided many clients through the powerful “mega backdoor Roth” strategy. This approach involves the strategic rollover of after-tax 401(k) contributions into a Roth IRA, creating a pathway to maximize your retirement savings with tax-free growth and withdrawals. The result? Significantly increased financial resources during your retirement years.

Today, I’ll walk you through every detail of this process, from basic concepts to implementation, helping you understand how to make this work for your specific situation.

Understanding the Foundation: After-Tax Contributions and Roth IRAs

Before diving into the strategy itself, let’s ensure you understand the two key components that make this approach possible.

After-Tax 401(k) Contributions

These contributions come from your income after all applicable taxes have been deducted. Unlike traditional pre-tax 401(k) contributions, they don’t reduce your taxable income in the year they’re made. However, they have a distinct advantage: while they grow tax-deferred within your 401(k), when rolled over correctly to a Roth IRA, all future growth becomes completely tax-free.

Roth IRAs: The Tax-Free Growth Vehicle

A Roth IRA is a retirement account where you contribute post-tax income. The primary benefit is that your money grows tax-free, and withdrawals in retirement are also tax-free, provided certain conditions are met. This makes Roth IRAs exceptional vehicles for long-term growth without future tax liabilities.

Contribution Limits: Understanding the Numbers

To understand why the mega backdoor Roth strategy is so valuable, we need to examine the standard retirement account contribution limits.

| Account Type | 2025 Contribution Limit | Catch-up (Age 50+) | Income Restrictions |

|---|---|---|---|

| Traditional/Roth IRA | $7,000 | $1,000 | Yes, for Roth IRAs |

| 401(k) Pre-tax/Roth | $23,500 | $7,500 (50-59 or 64+)

$11,250 (60-63, if your plan allows) |

No |

| 401(k) Total (Employee + Employer) | $70,000 | N/A | No |

The key insight here is the gap between the employee contribution limit ($23,500) and the total 401(k) limit ($70,000). This gap of $46,500 (minus any employer contributions) can potentially be filled with after-tax contributions, which can then be rolled over to a Roth IRA through the mega backdoor strategy.

The Strategic Importance of the Mega Backdoor Roth

Maximizing Tax Efficiency

The rollover allows you to shift after-tax funds into a Roth IRA where they can grow and be withdrawn tax-free. This strategic move is particularly advantageous for individuals who expect to be in a higher tax bracket during retirement, as it shields them from higher future taxes on the growth of these investments.

Visualizing the Long-Term Growth Potential

Consider this comparison of $50,000 invested over 30 years with an 8% annual return:

| Account Type | Initial Investment | Value After 30 Years | Taxes Due on Withdrawal | Net Retirement Value |

|---|---|---|---|---|

| Traditional 401(k) | $50,000 | $503,133 | $125,783 (25% tax bracket) | $377,350 |

| After-tax 401(k) (no rollover) | $50,000 | $503,133 | $113,283 (taxes on earnings only) | $389,850 |

| After-tax 401(k) rolled to Roth IRA | $50,000 | $503,133 | $0 | $503,133 |

As this table illustrates, the mega backdoor Roth strategy can potentially provide over $125,000 more in retirement funds compared to keeping the same amount in a traditional 401(k).

Flexibility in Retirement

Roth IRAs do not have Required Minimum Distributions (RMDs), giving you greater control over your funds throughout retirement. This flexibility allows for better tax planning strategies, letting you decide when and how much to withdraw based on your financial needs without mandatory distribution requirements.

Step-by-Step Rollover Process: Your Implementation Guide

- Eligibility Check: First Things First

Before taking any steps, you must verify that your 401(k) plan allows:

- After-tax contributions beyond the standard pre-tax limit

- In-service distributions or rollovers to IRAs

- Direct transfers to Roth accounts

Not all plans offer these features, so checking your plan documents or speaking with your HR department is essential. One of the first things I do with clients is to thoroughly review their plan documents to confirm eligibility.

- Setting Up the Right Accounts: Creating Your Financial Infrastructure

If you don’t already have one, you’ll need to open a Roth IRA. Choose a reputable financial institution that offers investment options aligning with your long-term retirement goals. Consider factors like:

- Fee structure (look for low expense ratios)

- Available investment choices

- Quality of customer service

- Account management tools

You might also need a traditional IRA to temporarily hold any pre-tax funds during the rollover process, especially if you’re dealing with earnings on your after-tax contributions.

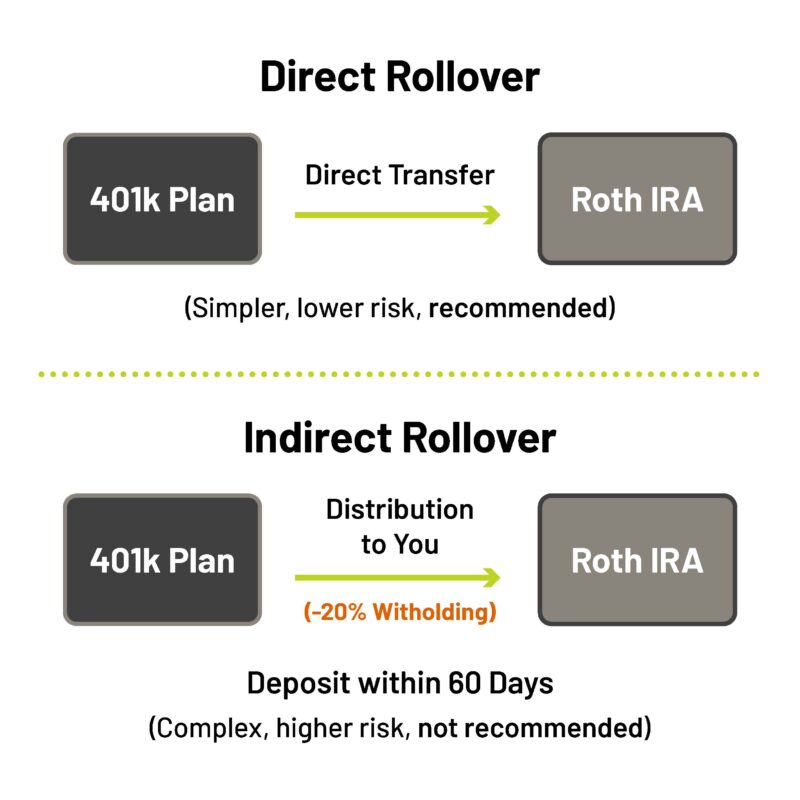

- Executing the Rollover: Direct vs. Indirect Methods

Direct Rollover: The Preferred Approach

In a direct rollover, funds transfer directly from your 401(k) to your Roth IRA without passing through your hands. This method offers several significant advantages:

- No mandatory tax withholding

- No risk of missing the 60-day redeposit deadline

- Clear documentation trail for tax purposes

- Simplified tax reporting

When I work with clients, I almost always recommend the direct rollover approach due to these advantages and the reduced risk of errors.

Indirect Rollover: Understanding the Challenges

With an indirect rollover, you receive the distribution yourself and must deposit it into your Roth IRA within 60 days. This approach comes with several drawbacks:

- 20% mandatory tax withholding that you must make up from other funds

- Risk of missing the 60-day deadline, which would trigger taxes and penalties

- More complex tax reporting requirements

- Higher chance of procedural errors

The flowchart below illustrates the decision process between direct and indirect rollovers:

- Confirming Tax Treatment: Ensuring Proper Documentation

After completing the rollover, it’s crucial to verify that:

- Your 401(k) plan issues Form 1099-R with the correct distribution code (typically code “G” for direct rollovers)

- Your Roth IRA custodian acknowledges the rollover contribution on Form 5498

- All documentation is properly maintained for your tax records

I’ve seen cases where clients faced unexpected tax bills because of incorrect coding on these forms. Don’t assume everything has been handled correctly – verify the paperwork yourself or have your financial advisor review it.

Avoiding Common Pitfalls: Lessons from Experience

Missed Deadlines: The 60-Day Rule

For indirect rollovers, failing to redeposit funds within 60 days can result in taxes and penalties. The undeposited amount becomes taxable income plus a possible 10% early withdrawal penalty if you’re under 59½.

Tax Implications: Understanding the Pro-Rata Rule

Incorrectly executed rollovers can lead to unexpected taxes. It’s crucial to understand the tax status of each portion of your 401(k):

- After-tax contributions: These roll over tax-free

- Earnings on after-tax contributions: These are taxable when rolled directly to a Roth IRA

Some plans allow separating these two components, directing the after-tax contributions to a Roth IRA and the earnings to a traditional IRA. This approach, sometimes called a “split rollover,” can defer the taxes on earnings.

Compliance Errors: Following IRS Guidelines

Ensure your 401(k) plan’s rules align with IRS regulations for rollovers. Misunderstandings can lead to non-compliance issues, potentially triggering tax liabilities. Working with an experienced financial advisor who specializes in retirement strategies can help you navigate these complex regulations.

Strategic Advantages for High-Income Earners: Breaking Through Contribution Limitations

High-income earners often face contribution limits with Roth IRAs due to IRS income restrictions. The mega backdoor Roth strategy circumvents these limits, allowing high-income individuals to enhance their retirement savings significantly.

Income Limits for Direct Roth IRA Contributions (2025)

| Filing Status | Phase-out Begins | Phase-out Complete |

|---|---|---|

| Single | $150,000 | $165,000 |

| Married Filing Jointly | $236,000 | $246,000 |

Source: IRS

The mega backdoor Roth completely bypasses these income restrictions, allowing high-income earners to effectively contribute significant amounts to a Roth IRA regardless of income level.

Maximizing Contributions: A Case Study

Consider Sarah, a tech executive earning $300,000 annually. Her employer matches 5% of her salary in her 401(k) plan.

| Contribution Type | Amount |

|---|---|

| Employee Pre-tax Contribution | $23,000 |

| Employer Match (5% of $300,000) | $15,000 |

| Available for After-tax Contributions | $31,000 ($69,000 – $23,000 – $15,000) |

| Total Potential Annual Retirement Savings | $69,000 |

By utilizing the mega backdoor Roth strategy, Sarah can effectively contribute an additional $31,000 to her Roth IRA each year, significantly increasing her tax-free retirement savings despite her high income.

Record-Keeping Best Practices: Protecting Your Strategy

Document Everything: Create a Paper Trail

- Keep all forms related to your rollover (1099-R, 5498)

- Save all correspondence with your 401(k) administrator and IRA custodian

- Record dates and amounts of all transactions

- Create digital backups of all documentation

I typically advise clients to create a dedicated folder (both physical and digital) for these documents and to retain them for at least seven years after the rollover.

Ongoing Management: The Importance of Regular Reviews

- Review your retirement accounts annually

- Consider whether additional rollovers would be beneficial as your financial situation changes

- Adjust your strategy as tax laws evolve

In my practice, I schedule annual retirement strategy reviews with clients to ensure their approach remains optimized as their situation and the regulatory environment change.

The Rollover Process: Why It Matters for Long-Term Success

Navigating the rollover process from after-tax 401(k) contributions to a Roth IRA might seem challenging due to its complexity, but mastering this financial maneuver can unlock profound long-term benefits. As your financial advisor with extensive experience in this area, I’ve successfully guided numerous clients through this transformative journey, ensuring their retirement savings are not just secure but optimized for significant growth.

Understanding the Importance of Tax Planning

The mega backdoor Roth strategy isn’t just about avoiding taxes – it’s about creating a foundational element of financial freedom in retirement. Here’s why this approach matters:

- Tax Diversification: Having different types of accounts (pre-tax, after-tax, and Roth) gives you flexibility in managing your tax situation throughout retirement.

- Protection Against Tax Rate Increases: With government debt and spending at historic levels, many financial experts anticipate higher tax rates in the future. Roth accounts provide insurance against this possibility.

- Estate Planning Benefits: Roth IRAs can be particularly valuable as inheritance vehicles, as beneficiaries can inherit your Roth IRA without owing income taxes on distributions.

Eligibility and Setup: Starting Right

Ensuring you start the rollover process correctly is crucial for leveraging the benefits of transitioning after-tax 401(k) funds into a Roth IRA. The initial steps involve confirming the eligibility of your current retirement plan for such transactions and setting up the appropriate accounts to receive the funds.

Plan Features Comparison: What to Look For

| Plan Feature | What to Check | Why It Matters |

|---|---|---|

| After-tax Contributions | Does the plan allow contributions beyond the $23,000 pre-tax/Roth limit? | This is the foundation of the strategy |

| In-service Distributions | Can you withdraw after-tax contributions while still employed? | Allows implementation without waiting until job change or retirement |

| Direct Roth Rollovers | Does the plan permit direct transfers to Roth IRAs? | Simplifies the process and reduces tax complications |

| Earnings Separation | Can the plan separate after-tax contributions from their earnings? | Allows for optimal tax treatment of each component |

Choosing the Right IRA Custodian: A Critical Decision

The selection of your Roth IRA provider is more important than many realize. Here are key factors to consider:

- Investment Options: Look for a wide range of low-cost index funds and ETFs

- Fee Structure: Avoid providers with high account maintenance fees or transaction costs

- User Experience: Consider the quality of online tools and educational resources

- Customer Service: Research the reputation for responsive support

As your advisor, I typically recommend custodians with multiple investment options and competitive fee structures, as these factors can significantly impact your long-term returns.

Execution: Implementing the Strategy Effectively

The execution phase is where many people make costly mistakes. Let me walk you through the process I use with my clients to ensure smooth implementation.

Timing Considerations: When to Execute

The timing of your mega backdoor Roth conversion can impact its effectiveness:

- End of Year: Some clients prefer to wait until December to assess their full financial picture before making after-tax contributions

- Early in Year: Others prefer to front-load contributions to maximize tax-free growth time

- Regular Intervals: Many find that regular monthly or quarterly conversions work best for their cash flow

There’s no universal “best time” – the right approach depends on your specific financial situation, which we would analyze together.

Communication is Key When Working with Plan Administrators

Clear communication with your 401(k) plan administrator is essential. I recommend:

- Scheduling a call specifically to discuss the mega backdoor Roth strategy

- Asking for written confirmation of the plan’s capabilities regarding after-tax contributions and in-service distributions

- Requesting step-by-step instructions for their specific process

- Confirming the required paperwork in advance

Many of my clients have found that plan administrators are unfamiliar with this strategy. Being prepared with specific questions can help overcome this knowledge gap.

Confirming the Tax Treatment of Your Conversion

After executing any type of rollover, particularly a direct rollover, it’s crucial to ensure that the financial institutions involved correctly report the transaction to the IRS. This step is key to confirming that your rollover receives the proper tax treatment and avoids potential complications.

Tax Form Checklist: What to Look For

| Form | Who Provides It | What to Verify | When to Expect It |

|---|---|---|---|

| 1099-R | 401(k) Provider | Box 7 Code “G” for direct rollover | January-February following the year of distribution |

| 5498 | IRA Custodian | Rollover amount | May following the year of contribution |

| 1040 | You prepare | Proper reporting of rollover | Tax filing deadline |

Common Reporting Errors to Watch For

- Incorrect Distribution Codes: Ensure the 1099-R shows code “G” not code “1” (which would indicate a taxable distribution)

- Missing Rollover Designation: Verify that your IRA custodian properly coded the contribution as a rollover

- Mismatched Amounts: Confirm that the amount on Form 5498 matches the distribution amount on Form 1099-R

Maintaining Records and Avoiding Pitfalls

Maintaining meticulous records and steering clear of common rollover mistakes are crucial aspects of managing your retirement savings efficiently. I’ve developed a system for my clients that helps prevent costly errors.

The Essential Mega Backdoor Roth Documentation File

Create a dedicated file (physical or digital) containing:

- All plan documents confirming after-tax contribution eligibility

- Records of all after-tax contributions made to your 401(k)

- Distribution paperwork showing the rollover request

- Confirmation statements from your Roth IRA custodian

- All tax forms (1099-R, 5498)

- Annual statements showing growth of the rolled-over funds

This comprehensive documentation protects you in case of IRS questions and provides a clear trail of your strategic decisions.

A Timeline Approach: Monitoring the Process

For each rollover, create a timeline tracking:

- Date of after-tax contribution to 401(k)

- Date rollover was requested

- Date funds were received by Roth IRA

- Dates tax forms were received

- Date tax return was filed reporting the rollover

This timeline approach ensures nothing falls through the cracks during the multi-step process.

Benefits of a Mega Back Door Roth Strategy

The mega backdoor Roth strategy isn’t just a technical tax maneuver – it fundamentally transforms retirement outcomes. I’ve seen this firsthand with clients who implemented this approach years ago and are now enjoying the benefits.

Case Study: The Long-Term Impact

Consider two clients with similar careers, earnings, and saving habits:

- Maxed out pre-tax 401(k) contributions for 25 years

- Accumulated $2.1 million in retirement accounts

- Now faces RMDs and tax consequences on withdrawals

- Retirement income limited by tax considerations

- Same pre-tax 401(k) contributions as Client A

- Additionally utilized mega backdoor Roth for 25 years

- Accumulated $3.4 million total in retirement accounts

- $1.7 million in tax-free Roth accounts

- Greater flexibility in retirement income planning

- No RMDs on Roth portion

- Significantly lower tax burden in retirement

The difference in retirement lifestyle between these two clients is substantial, with Client B enjoying both greater wealth and greater freedom in how to use it.

Looking Ahead: Future-Proofing Your Strategy

Tax laws are subject to change, and retirement planning must evolve accordingly. As your advisor, part of my role is to help you adapt your strategy as the regulatory environment shifts.

Potential Legislative Changes to Monitor

- Proposals to eliminate the mega backdoor Roth strategy have been introduced in Congress

- Changes to contribution limits are regularly considered

- RMD rules have been modified several times in recent years

We would monitor these developments together and adjust your strategy as needed to ensure ongoing optimization of your retirement plan.

Regular Review Schedule: Staying on Track

I recommend:

- Quarterly check-ins on contribution progress

- Annual reviews of overall retirement strategy

- Immediate reassessment when tax laws change or your financial situation shifts significantly

This proactive approach ensures your retirement planning remains aligned with both your goals and the current regulatory environment.

Conclusion: Your Path Forward

The mega backdoor Roth strategy represents a sophisticated approach to retirement planning that can significantly improve your financial future. While the process may seem complex, the long-term benefits make it worthwhile.

Remember that tax laws can change, and individual situations vary. I recommend we review your retirement strategy annually to ensure it continues to serve your long-term financial goals.

The journey to a tax-free retirement starts with a single step – understanding how to make the mega backdoor Roth work for your specific situation. I’m here to help you take that step and all those that follow on your path to financial freedom.