The Strategic Advantage: Using ESOPs for Business Succession Planning

As a financial advisor with decades of experience in business transition planning, I often find that business owners face important questions about succession. Many want to know: “What’s the best way to exit my business while protecting my financial future and maintaining my company’s legacy?”

Among the options available to business owners, Employee Stock Ownership Plans (ESOPs) stand out as a powerful solution for many business owners. Let me walk you through why ESOPs might be the right choice for your situation, and how they work as part of a comprehensive exit strategy.

What Is an ESOP?

An ESOP is a qualified retirement plan that invests in the stock of the employing company. Think of it as a specialized trust that holds company shares for the benefit of employees. As employees work for the company, they gain ownership rights to these shares, which can provide them with financial security upon retirement.

Unlike traditional retirement plans, ESOPs create a direct connection between a workers employment and company ownership. This unique characteristic makes ESOPs particularly valuable for business succession planning.

Why Consider an ESOP for Your Business Transition?

Financial Benefits for Owners

When selling your business through an ESOP, you can receive significant tax advantages that aren’t available with other exit strategies:

- Section 1042 Tax Deferral: If your company is a C corporation, you can defer capital gains taxes by reinvesting the proceeds in qualified replacement securities (typically domestic stocks and bonds). This can dramatically improve your after-tax cash position.

- Flexible Transaction Structure: You can sell all at once or in stages, allowing you to gradually transition out of the business while maintaining control during the process.

- Fair Market Value: ESOPs must pay fair market value for your shares, as determined by an independent valuation firm. This ensures you receive appropriate compensation for the business you’ve built.

Benefits for Your Company

Beyond personal financial gains, ESOPs offer substantial advantages for your business:

- Tax Deductions: Companies can deduct contributions to the ESOP, including both principal and interest payments on ESOP loans.

- S Corporation Tax Savings: S corporations owned by ESOPs don’t pay federal income tax on the portion owned by the ESOP. A 100% ESOP-owned S corporation pays no federal income tax, increasing cash flow for debt service and growth.

- Cash Flow Management: The gradual nature of many ESOP transactions allows for manageable cash flow during the transition period.

Legacy Preservation

Many business owners worry about what will happen to their company culture, employees, and community presence after they exit. ESOPs address these concerns by:

- Maintaining Company Independence: Unlike selling to a competitor or private equity firm, an ESOP allows your business to remain independent.

- Preserving Jobs and Culture: With an ESOP, your employees become the new owners, reducing the risk of layoffs or dramatic cultural shifts.

- Supporting Your Community: ESOPs help keep businesses locally owned, maintaining their economic impact on the community.

How ESOPs Work: The Mechanics of Implementation

Understanding the mechanics helps clarify how ESOPs function in practice:

- ESOP Formation

The company establishes a trust to hold company stock for employees. This requires:

- Creating trust documents

- Appointing a trustee

- Setting up plan administration

- Defining participation criteria

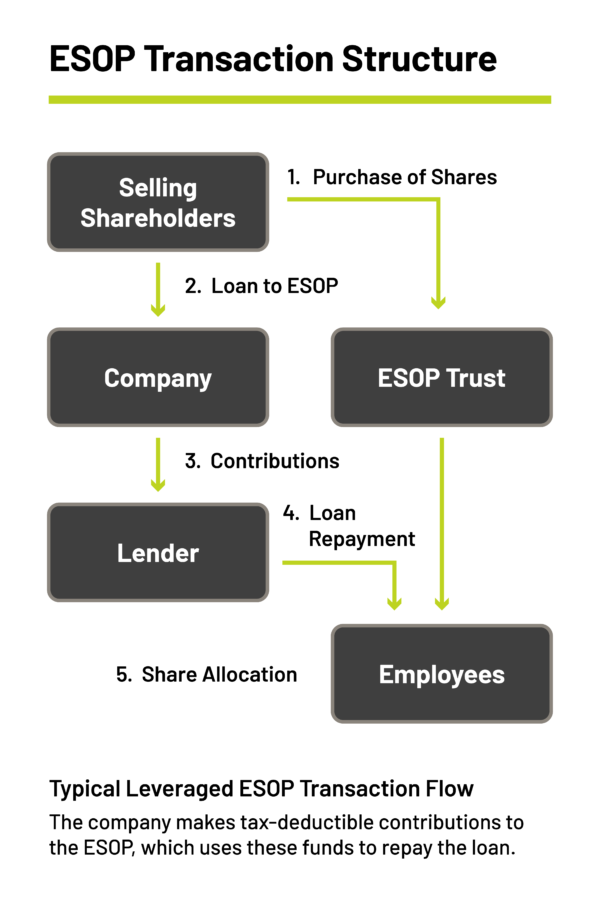

- Transaction Structure

The ESOP purchases company stock through one of these methods:

- Direct Contribution: The company contributes cash or shares directly to the ESOP

- Leveraged ESOP: The ESOP borrows money to purchase shares, with the company making tax-deductible contributions to repay the loan

- Share Allocation

Shares are allocated to employee accounts based on:

- Relative compensation

- Years of service

- A combination of both factors

- Vesting and Distribution

Employees gain rights to their shares over time through a vesting schedule. When they retire or leave the company, they receive their vested benefits, which can be:

- Distributed as stock

- Paid in cash

Rolled over to another retirement account

ESOP vs. Other Succession Options: A Comparative Analysis

When planning your exit strategy, it’s important to weigh ESOPs against other common options:

Real-World Success: Case Study Analysis

Let me share a client story that illustrates the power of ESOPs:

Midwest Manufacturing Company

A family-owned manufacturing business with 150 employees and $30 million in annual revenue faced a succession dilemma. The owner, approaching retirement, received offers from competitors but worried about his employees and company legacy.

The ESOP Solution:

- Structured a sale to an ESOP at $25 million valuation

- Owner retained 30% ownership initially, selling fully over five years

- Used Section 1042 election to defer capital gains taxes

- Invested proceeds in qualified replacement securities

Results:

- Owner received full fair market value

- Deferred over $4 million in capital gains taxes

- Company gained $800,000 annual tax savings as an S-Corp ESOP

- Employee retirement accounts averaged $175,000 after seven years

- Company maintained independence and grew revenue by 35%

This case demonstrates how ESOPs can create a win-win scenario for owners, employees, and the business itself.

Financial Impacts: Tax Benefits Deep Dive

Let’s examine the tax advantages of ESOPs more closely:

For Selling Shareholders

The Section 1042 tax deferral is perhaps the most significant tax benefit for shareholders selling to an ESOP. This provision allows sellers to defer capital gains taxes indefinitely by:

- Selling qualified securities (stock in a domestic C corporation)

- Holding the securities for at least 3 years prior to sale

- Selling to an ESOP that owns at least 30% of company stock

- Reinvesting proceeds in qualified replacement securities within 12 months

This can result in substantial tax savings. For example, on a $10 million sale with a $1 million basis, deferring the capital gains tax could save approximately $1.8 million in federal taxes alone.

Implementation Considerations: Making ESOPs Work for You

If you’re considering an ESOP, here are key implementation factors to address:

Feasibility Assessment

Before proceeding with an ESOP, conduct a thorough feasibility study that examines:

- Company Valuation: What is your business worth in the marketplace?

- Financial Projections: Can your company support ESOP debt payments?

- Management Succession: Who will lead the company after your departure?

- Corporate Structure: What entity type makes the most sense (C or S Corporation)?

Professional Team Assembly

Implementing an ESOP requires specialized expertise. Your advisory team should include:

- ESOP Attorney: Specializing in ERISA law and ESOP transactions

- Valuation Firm: Experienced with ESOP valuations

- Financial Advisor: Knowledgeable about ESOP financing options

- Third-Party Administrator: To handle ongoing ESOP compliance and administration

- Certified Exit Planning Advisor (CEPA): To coordinate the overall exit strategy

Timeline Expectations

ESOP transactions typically follow this timeline:

- Feasibility Analysis: 1-3 months

- Plan Design and Legal Documentation: 2-3 months

- Financing Arrangements: 1-3 months

- Transaction Closing: 1 month

- Implementation and Communication: Ongoing

Post-Transaction Planning

Your involvement doesn’t necessarily end with the ESOP transaction. Consider:

- Transitional Leadership Role: Many owners remain as board members or executives during a transition period

- Financial Management: How will you invest proceeds from the sale?

- Personal Financial Planning: How does this transaction fit into your retirement strategy?

Common Misconceptions About ESOPs

Let me address some common myths about ESOPs:

“Employees need to pay for their stock.”

Reality: Employees receive stock as a retirement benefit without personal investment.

“I’ll get less money selling to an ESOP than to a strategic buyer.”

Reality: While strategic buyers might offer higher gross prices, the after-tax proceeds from an ESOP sale can be comparable or better.

“Employees will control company decisions.”

Reality: ESOP participants typically have limited voting rights. Strategic decisions remain with management and the board.

“ESOPs are only for large companies.”

Reality: Companies with as few as 20 employees and valuations of $3-5 million can successfully implement ESOPs.

“ESOPs are too expensive to set up.”

Reality: While implementation costs exist, they’re often comparable to other succession options and are offset by tax benefits.

The Strategic Role of a Certified Exit Planning Advisor (CEPA)

When implementing an ESOP, working with a Certified Exit Planning Advisor (CEPA) is crucial for several reasons:

Comprehensive Exit Planning Expertise

A CEPA brings specialized knowledge in exit planning that goes beyond just the transaction mechanics. They understand how an ESOP fits into your broader financial and personal goals, ensuring alignment between your exit strategy and long-term objectives.

Value Enhancement Strategies

Before implementing an ESOP, a CEPA can help identify opportunities to increase your company’s value. This pre-transaction work often results in a higher valuation, benefiting both you and your future employee-owners.

Coordinated Professional Team

The ESOP process involves multiple specialized professionals. A CEPA serves as the quarterback of this team, coordinating efforts between:

- ESOP attorneys and ERISA specialists

- Valuation professionals

- Financial institutions

- Tax advisors

- Third-party administrators

Balanced Perspectives

A qualified CEPA provides objective analysis of all exit options, not just ESOPs. This ensures you’re making an informed decision based on your specific circumstances rather than forcing a particular solution.

Post-Transaction Support

The relationship with your CEPA extends beyond the ESOP transaction. They can assist with:

- Personal wealth management of sale proceeds

- Estate planning considerations

- Management transition planning

- Ongoing ESOP optimization strategies

Research shows that business owners who work with CEPAs throughout their exit planning process report higher satisfaction with their transitions and better financial outcomes. The structured approach a CEPA brings to the exit planning process helps prevent costly mistakes and ensures your business legacy continues as you intended.

Conclusion: Is an ESOP Right for Your Business?

After advising numerous business owners on succession planning, I’ve found that ESOPs work particularly well for companies with these characteristics:

- Stable, profitable operations with positive cash flow

- Strong management team that can continue after owner departure

- Corporate culture that values employee participation

- Owner desire to preserve company legacy and independence

- Adequate company size (typically $3 million+ in value and 20+ employees)

However, ESOPs aren’t right for every situation. They may not be ideal if:

- You seek the absolute highest immediate sale price

- Your company has volatile earnings or poor cash flow

- You need a complete exit immediately

- There’s no strong management team in place

The decision to implement an ESOP should be based on a thorough analysis of your specific circumstances, goals, and company characteristics. Working with experienced advisors, particularly a Certified Exit Planning Advisor (CEPA), is essential to navigate this complex process successfully.

By carefully considering the financial, tax, legacy, and employee benefits, you can determine whether an ESOP represents the optimal path for your business succession journey. When properly structured and implemented, an ESOP can create tremendous value for all stakeholders involved, securing your financial future while preserving the business you’ve worked so hard to build.

Remember, succession planning is not just about the transaction, it’s about transition, legacy, and the future of everything you’ve created. An ESOP might just be the solution that checks all those boxes for you and your business.

fully invested in the plan over time, commonly spanning five to seven years. Upon retirement or leaving the company, employees receive payouts based on the vested shares, thus securing a retirement benefit tied directly to the company’s performance.

The core objective of an ESOP is not only to provide a retirement benefit but also to foster a corporate culture where employees are genuinely invested in the company’s success. This alignment of interests motivates employees to work towards sustaining and growing the business, knowing that they will directly benefit from its success. Through this structure, ESOPs serve as a powerful tool for enhancing employee loyalty and commitment while also facilitating smooth ownership transitions.

The Strategic Framework of ESOPs

Employee Stock Ownership Plans (ESOPs) provide a unique mechanism for business succession planning, distinguished by their investment in employer stock and operation under stringent regulatory frameworks. Understanding the legal and financial foundations of ESOPs is crucial for navigating their complexities effectively.

Regulatory Compliance

ESOPs are governed by a detailed regulatory framework that mandates compliance with specific provisions of the Internal Revenue Code (IRC) and the Employee Retirement Income Security Act (ERISA). This compliance is vital to ensure that the benefits of the ESOP are broad-based and accessible to all eligible employees, not just high-ranking executives. Adhering to these regulations helps maintain the ESOP’s integrity and guarantees that the benefits extend across the employee spectrum, promoting fairness and inclusivity.

Fiduciary Oversight

One of the key components of an ESOP’s strategic framework is fiduciary oversight. ESOPs are managed by trustees who are obligated to act in the best interests of the plan participants. This involves rigorous valuation processes to ascertain the fair market value of the company stock, ensuring that employees do not overpay. Fiduciary responsibilities also include managing the plan’s assets prudently and ensuring that the ESOP complies with all applicable laws and regulations.

Financial Leveraging

From a financial perspective, ESOPs offer several benefits that can enhance their appeal to business owners. They can be funded through direct company contributions of stock or through leveraging – using loans to buy company shares. The interest payments and principal repayments on these loans are tax-deductible, providing significant tax advantages to the company. This setup not only facilitates the ESOP’s growth by increasing its assets but also provides the company with a tax-efficient method of funding employee retirement benefits.

This strategic framework supports fiscal prudence and safeguards the plan’s integrity, making ESOPs a reliable and effective option for business succession. The structured environment of an ESOP not only ensures compliance with rigorous standards but also enhances the overall fiscal health of the company, making it an advantageous choice for both owners and employees aiming for a stable and prosperous future.

Tax Implications and Incentives of ESOPs

Employee Stock Ownership Plans (ESOPs) offer a variety of tax benefits that make them an attractive option for business succession. These tax advantages not only facilitate a smoother transition of ownership but also provide substantial economic incentives that can enhance company value and employee satisfaction.

Deductibility of Contributions

One of the primary tax benefits of an ESOP is the deductibility of contributions. Similar to other qualified retirement plans, contributions made to an ESOP, whether in cash or stock, are tax-deductible. This can reduce a company’s taxable income significantly, easing the financial strain often associated with funding retirement plans. For businesses, this translates into improved cash flow and lower operational costs, making it a financially sound strategy in long-term business planning.

Capital Gains Tax Deferral

For owners selling to an ESOP, capital gains tax deferral presents a highly favorable tax incentive. If certain conditions are met—primarily that the ESOP must own at least 30% of the company’s shares post-transaction—sellers in C corporations can defer capital gains taxes. This deferral can be indefinite as long as the proceeds from the sale are invested in qualified securities. This aspect of ESOPs can substantially increase the net proceeds from the sale, making it an appealing option for owners looking to retire or exit the business.

S Corporation Benefits

S corporations with ESOPs enjoy unique tax benefits that are not available to other business types. The most notable is the exemption from federal (and often state) income tax on the proportion of profits that corresponds to the ESOP’s ownership percentage. For instance, if an ESOP owns 50% of an S corporation, then 50% of the business’s profits would be exempt from federal income tax. This can lead to substantial tax savings and significantly improve the company’s cash flows, providing a direct boost to its financial health.

Additional ESOP-Related Tax Incentives

- Dividend Deductions: ESOPs in C corporations can also deduct dividends paid on ESOP-held shares, provided these dividends are used to repay a loan the ESOP takes out to buy company shares or are passed through to employees.

- Contribution Limits: The limits on annual contributions to an ESOP are higher than many other retirement plans, which allows for greater tax-deductible contributions.

These tax implications and incentives underline the financial viability of adopting an ESOP as a business succession plan. By leveraging these benefits, companies can not only facilitate a cost-effective transition but also bolster their financial stability and reward employees, fostering a more committed and productive workforce.

Comparing ESOPs with MBOs and PE Sales

Understanding the nuances between Employee Stock Ownership Plans (ESOPs), Management Buyouts (MBOs), and Private Equity (PE) sales is crucial for business owners considering succession planning. Each strategy has its distinct benefits and challenges, tailored to meet different business needs and owner preferences.

ESOPs: Employee Engagement and Tax Benefits

ESOPs offer a unique model where employees become the owners of the company through a trust set up on their behalf. This approach not only fosters broad employee engagement but also comes with significant tax benefits. ESOPs can improve workforce morale and productivity as employees share in the success of the company. The tax advantages include deferral of capital gains and tax-deductible contributions that can enhance the company’s cash flow. Additionally, ESOPs often focus on preserving the legacy of the company, making them suitable for owners who prioritize continuity over outright profit from a sale.

MBOs: Focused Ownership and Continuity

Management Buyouts are transactions where a company’s existing managers acquire a significant portion or all of the ownership from the current owners. MBOs can ensure business continuity and maintain company culture because the new owners are already familiar with and invested in the business’s success. Unlike ESOPs, MBOs do not involve broader employee ownership but concentrate ownership among key managers, which can lead to enhanced commitment and strategic alignment with business goals without the complexities of managing a broad-based ownership structure.

PE Sales: Liquidity and High Returns

Private Equity sales involve selling the company or a significant part of it to a private equity firm. This route is often chosen for its potential to provide immediate liquidity and high returns. PE firms can bring in additional management expertise, strategic direction, and capital to drive growth. However, a PE sale may significantly alter the company’s culture and control, as PE firms may prioritize financial performance and operational efficiency, potentially leading to significant changes in company structure and strategy.

Strategic Considerations

Deciding between these options requires a clear understanding of the business’s long-term goals and the owner’s personal preferences. ESOPs might be ideal for owners who value employee welfare and legacy preservation, MBOs for those who wish to pass the torch to trusted lieutenants, and PE sales for those seeking financial exit or next-level growth through strategic partnerships.

This comparative analysis is vital for pinpointing the most appropriate succession strategy based on the specific objectives and circumstances facing a business owner. Each option presents a different set of opportunities and challenges, and the right choice depends on aligning the business’s needs with the strategic goals of the owner.

Conclusion: Why ESOPs Could Be Your Best Choice

Employee Stock Ownership Plans (ESOPs) offer a uniquely beneficial approach to business succession, combining financial advantages, employee engagement, and continuity planning. This makes them an ideal strategy for business owners looking to transition their company while also investing in the future success of their workforce.

Balancing Financial Incentives and Employee Welfare

ESOPs stand out by providing substantial tax benefits, which can enhance the financial health of the company and reduce the fiscal stress associated with transition periods. The structure of ESOPs allows for contributions to be tax-deductible, and the company can leverage these contributions for significant financial planning advantages. Furthermore, by aligning employee interests with those of the company, ESOPs boost morale and productivity, leading to potentially higher business performance and profitability.

Embedding a Culture of Ownership

One of the most profound impacts of adopting an ESOP is the cultivation of an ownership culture. Employees who are owners, even partially, tend to be more committed, motivated, and aligned with the company’s goals. This shift not only aids in smoother transitions when the time comes for leadership changes but also instills a long-term stewardship mindset among employees, ensuring the company’s legacy and ongoing success.

Secure Legacy and Empower Employees

By choosing an ESOP, business owners can secure their legacy in a way that honors their life’s work and respects the contributions of those who have helped build the company. The ESOP ensures that the company continues to operate in the spirit envisioned by its founder while empowering employees to contribute to and benefit from its success.

Personalized Guidance and Expert Support

For those considering an ESOP or other business succession options, specialized guidance is essential. In Austin, TX, our team of financial experts and CPAs is ready to assist you in navigating these complex decisions. We provide personalized consulting to ensure that your business transition strategy not only meets your financial objectives but also aligns with your personal values and the long-term goals of your company.

Implementing an ESOP can be a transformative decision for your business, providing a sustainable and rewarding path forward for both owners and employees. With expert support, this transition can lead to renewed growth and success, ensuring that the business thrives for generations to come.