Smart Money Moves: Your Guide to Financial Optimization in 2025

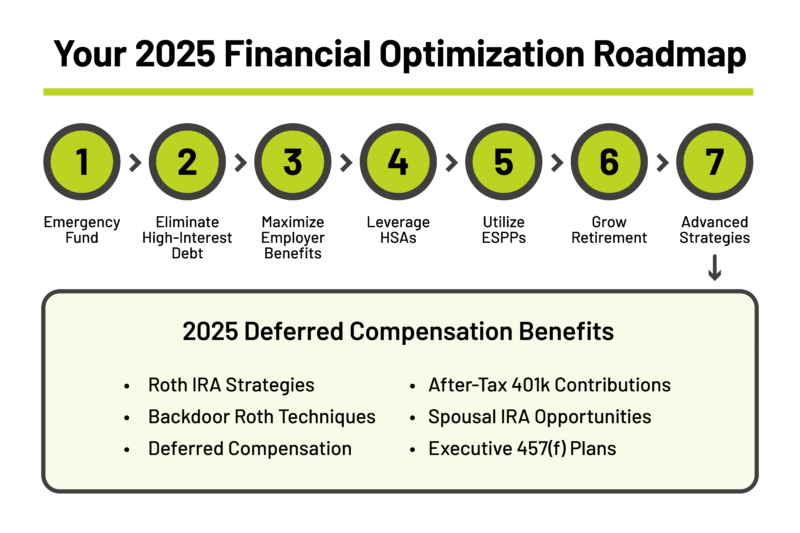

I’m excited to share practical strategies to strengthen your financial foundation in today’s economic landscape. Smart money management isn’t about complex maneuvers—it’s about the fundamentals and implementing proven strategies consistently. Let’s explore nine key approaches that can dramatically improve your financial health and long-term wealth outlook.

-

Building Your Emergency Fund: Your Financial Safety Net

The foundation of any solid financial plan is an emergency fund that is large enough to help you manage your way through challenging financial times. creates financial stability that allows you to make other wealth-building decisions with confidence.

Why Your Emergency Fund Matters

An emergency fund serves as your first line of defense against unexpected financial shocks. Think of it as a financial buffer that protects you from tapping into long-term investments or accumulating high-interest debt when life throws you a curveball.

| Emergency Fund Size | Appropriate For |

|---|---|

| 3 months of expenses | Dual-income households with stable jobs, good job security, minimal debt |

| 4-5 months of expenses | Single-income households, moderate job stability, some non-mortgage debt |

| 6+ months of expenses | Self-employed, commission-based income, unstable industry, caregiving responsibilities |

Building Your Fund Strategically

For 2025, consider these specific approaches:

- Target amount: Aim for 3-6 months of essential expenses based on your personal situation from the table above.

- Account selection: Use a high-yield savings account that balances accessibility with growth. For 2025, look for accounts offering at least 3.5-4.25% APY based on projected interest rate environments.

- Systematic saving: Create an automatic transfer from your checking account to your emergency fund each payday. Start with whatever percentage you can manage—even 3-5% of your income until you have reached your goal.

- Regular reassessment: Review your emergency fund every 6 months to ensure it still covers your needs as your life circumstances change.

-

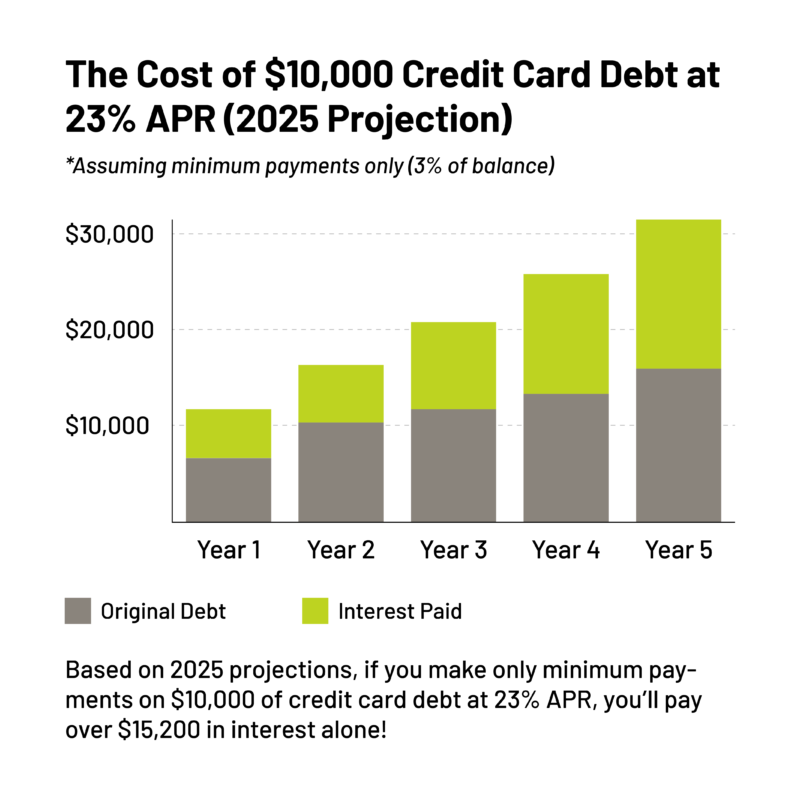

Eliminating High-Interest Debt: Stop the Financial Bleeding

High-interest debt is one of the biggest obstacles to building wealth. With credit card interest rates projected to average 21-25% in 2025, this type of debt can completely undermine your long term financial objectives.

Debt Repayment Strategy Comparison Table for 2025

| Strategy | Best For | Pros | Cons |

|---|---|---|---|

| Debt Avalanche | Mathematically-minded people | Saves the most money overall | May take longer to see progress |

| Debt Snowball | Motivation-driven people | Creates early wins and momentum | Costs more in total interest |

| Debt Consolidation | Good credit score (680+) | Simplifies payments, reduces rates | May extend repayment timeline |

| Balance Transfer | Excellent credit (720+) | 0% interest period (12-21 months) | Transfer fees (3-5%), high rates after promo |

Effective Debt Elimination Strategies for 2025

For 2025, consider these strategic approaches based on projected interest rate environments:

- Prioritize by interest rate (Debt Avalanche): List all your debts from highest to lowest interest rate. Make minimum payments on all debts, but allocate any extra money toward the highest-rate debt first.

- Consider strategic consolidation: With projected 2025 rates, focus on balance transfer offers with 0% introductory periods of 18+ months and transfer fees below 3%, which remain available for those with excellent credit.

- Create a structured payment plan: Set specific monthly payment amounts that exceed minimums and stick to them consistently. Track your progress to stay motivated.

-

Maximizing Employer Benefits: Don’t Leave Money on the Table in 2025

Many employees don’t take full advantage of their workplace benefits, essentially leaving free money unclaimed. For 2025, here’s what you need to know about optimizing employer benefits:

Key 2025 Employer Benefits Comparison

| Benefit Type | 2025 Limits | Tax Advantage | Notes for 2025 |

|---|---|---|---|

| 401(k) Match | Typical: 3-6% of salary | Tax-deferred growth | Immediate 50-100% ROI |

| HSA Contribution | $4,150 Individual $8,300 Family +$1,000 (age 55+) |

Triple tax advantage | Most tax-efficient account available |

| ESPP | $25,000 annual maximum | Potential 15%+ discount | Lookback provisions add significant value |

| FSA | $3,200 healthcare $5,800 dependent care |

Pre-tax contributions | Use-it-or-lose-it by year end |

| Tuition Assistance | Typically $5,250 tax-free | Pre-tax benefit | Growing in popularity for 2025 |

Contribution limits Source:IRS

Strategic Benefit Selection for 2025

For 2025, optimize your employer benefits with these specific strategies:

- 401(k) match: Meet the full match requirement, even if it requires adjusting your budget elsewhere. For 2025, the projected employee contribution limit is $23,500 ($31,000 if age 50+).

- Health insurance optimization: For 2025, analyze whether a high-deductible health plan paired with an HSA makes sense for your situation. Premium differentials between traditional and high-deductible plans are projected to widen further in 2025.

- Employee stock purchase plans: For 2025, many companies continue to offer ESPPs with 5-15% discounts. Take advantage of these programs as part of your investment strategy.

-

Utilizing Health Savings Accounts (HSAs): The Triple Tax Advantage

If you have access to a Health Savings Account through a high-deductible health plan, you’re looking at one of the most tax-advantaged accounts available for 2025.

2025 HSA Key Information Table

| HSA Feature | 2025 Limits |

|---|---|

| Contribution Limits | $4,150 Individual $8,300 Family +$1,000 catch-up (age 55+) |

| Required HDHP Deductible | Minimum $1,600 Individual Minimum $3,200 Family |

| HDHP Out-of-Pocket Maximum | $8,050 Individual $16,100 Family |

| Tax Benefits | Tax-deductible contributions Tax-free growth Tax-free withdrawals for qualified expenses |

| Investment Options | Typically available once balance exceeds $1,000-$2,000 |

Source:IRS

Strategic HSA Usage for 2025

For 2025, consider these specific HSA optimization approaches:

- Maximize contributions early: Front-load your HSA contributions early in 2025 if your cash flow allows, giving your investments more time to grow tax-free.

- Invest your HSA funds: Many HSA providers have significantly improved their investment options for 2025. Look for low-cost index funds with expense ratios under 0.20%.

- Pay medical expenses out-of-pocket: If your financial situation allows, pay smaller medical costs with non-HSA funds and let your HSA investments grow. Save receipts for qualified expenses indefinitely—there’s no time limit on reimbursement.

-

Leveraging Employee Stock Purchase Plans (ESPPs): Built-in Returns

For 2025, ESPPs continue to offer significant benefits with potential returns that often outpace other investment options.

2025 ESPP Strategy Comparison

| Strategy | Best For | Tax Treatment | Risk Level |

|---|---|---|---|

| Immediate Sale | Risk-averse investors | Discount taxed as ordinary income | Lowest risk |

| Hold 1+ Year | Higher risk tolerance | Potential LTCG treatment on a portion | Medium risk |

| Hold 2+ Years | Company loyalists | Most favorable tax treatment | Highest risk (concentration) |

Strategic ESPP Participation for 2025

- Participation level: For 2025, consider contributing as much as your budget allows up to the $25,000 annual limit. The discount represents an immediate return on investment.

- Selling strategy: For most investors, selling shares immediately after purchase locks in the discount as profit while eliminating single-stock risk. This approach guarantees returns of 5-15% on your money.

- Tax planning: For 2025, immediate sales will typically result in the discount being taxed as ordinary income. Plan accordingly for quarterly estimated tax payments if your withholding won’t cover the additional tax.

-

Growing Your Retirement Savings: The Power of Compound Growth

For 2025, leveraging retirement accounts effectively remains a cornerstone of long-term financial success.

2025 Retirement Account Comparison

Investment Allocation Strategies for 2025

Based on projected 2025 market conditions:

- Asset allocation strategy: For 2025, consider using the age-based guidelines in the table above as a starting point, adjusting based on your personal risk tolerance.

- Diversification approach: Spread investments across different asset classes, geographic regions, and investment styles to reduce risk.

- Fee awareness: For 2025, continue to focus on low-cost index funds and ETFs with expense ratios under 0.15% for core portfolio positions.

-

Maximizing Roth IRA Opportunities: 2025 Tax-Free Growth Potential

For 2025, Roth IRAs continue to offer powerful tax advantages with some updated parameters and strategies.

2025 Roth IRA Key Information Table

| Roth IRA Feature | 2025 Details |

|---|---|

| Contribution Limit | $7,000 +$1,000 catch-up (age 50+) |

| Income Phaseout (Single) | $146,000 – $161,000 |

| Income Phaseout (Married) | $230,000 – $240,000 |

| Conversion Eligibility | No income limits on conversions |

| Tax Treatment | After-tax contributions Tax-free growth Tax-free qualified withdrawals |

Source:IRS

Employer Retirement Plan Rollover for a Back-Door Roth Contribution

For 2025, the Back-Door Roth strategy remains viable for higher-income earners who exceed Roth IRA income limits. This approach involves making non-deductible contributions to a traditional IRA, then converting those funds to a Roth IRA shortly afterward.

When rolling over employer retirement funds in 2025, optimize the process by directing pretax dollars into traditional accounts while moving after-tax contributions into Roth accounts. This “split rollover” preserves the tax-free treatment of after-tax contributions.

For maximum effectiveness in 2025, maintain clean accounting by avoiding mixing pretax and after-tax funds in the same traditional IRA. Consider consolidating pretax IRAs into an employer 401(k) if available, leaving only after-tax funds in IRAs for cleaner conversions. {See MEGA Backdoor Roth Blog]

Spousal IRA: Expanded Opportunities for 2025

For 2025, spousal IRAs remain a powerful way for non-working or lower-income spouses to build retirement savings. Even with minimal earned income, the working spouse can contribute up to $7,000 ($8,000 if age 50+) to an IRA for their spouse, effectively doubling the household’s IRA contribution capacity.

This strategy is particularly valuable in 2025 for:

- Families with a stay-at-home parent

- Couples where one spouse has lower income or works part-time

- Households where one spouse owns a business with fluctuating income

The 2025 income limits and contribution amounts match those of regular IRAs, making this an accessible strategy for most married couples.

-

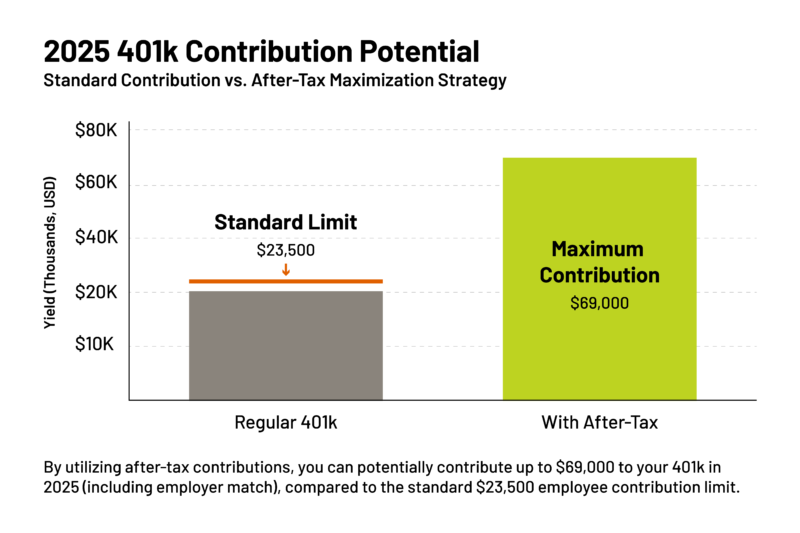

After-Tax Contributions to Your Workplace Retirement Plan: The Ultimate Savings Accelerator for 2025

For ambitious savers looking to supercharge their retirement strategy in 2025, after-tax contributions to workplace retirement plans represent one of the most powerful wealth-building opportunities available. This strategy allows you to dramatically exceed the standard employee contribution limits while creating substantial tax-advantaged growth potential.

After-Tax Contribution Limits to Your 401(k) Plan for 2025

While regular employee deferrals for 2025 are capped at $23,500 ($31,000 for those 50+), the total contribution limit across all sources—including employer matches and after-tax contributions—reaches an impressive $69,000 ($76,500 for those 50+). This creates substantial additional capacity that savvy investors can leverage.

| 401(k) Contribution Type | 2025 Details | Tax Treatment | Key Advantages |

|---|---|---|---|

| Traditional/Roth Deferrals | $23,500 +$7,500 (50+) |

Traditional: Pre-tax Roth: After-tax |

Reduces taxable income (Traditional) Tax-free growth (Roth) |

| Employer Contributions | Varies by plan | Pre-tax | Free money that grows tax-deferred |

| After-Tax Contributions | Up to overall limit | After-tax | Allows additional contributions beyond deferral limit |

| Total Plan Limit | $69,000 +$7,500 (50+) |

Mixed | Maximum possible retirement savings |

Contribution limits Source:IRS

The real power of this strategy emerges when your plan allows either in-service withdrawals or in-plan Roth conversions of these after-tax funds. By contributing after-tax dollars and then promptly rolling them into a Roth IRA or Roth 401(k), you effectively create a "Mega Backdoor Roth" conversion that bypasses the normal Roth contribution limits.

2025 Strategy: Implementing the Mega Backdoor Roth

For 2025, here's how to determine if this strategy works for your situation:

- Plan eligibility verification: Contact your benefits department to confirm:

- Your plan allows after-tax contributions (beyond regular pre-tax/Roth)

- The plan permits either in-service distributions or in-plan Roth conversions

- Any specific plan limits on after-tax contributions

- Contribution sequencing: For optimal results in 2025:

- First, contribute enough to get your full employer match

- Then, max out your regular pre-tax or Roth contributions ($23,500 for 2025)

- Finally, make after-tax contributions up to the overall limit

- Conversion timing: For maximum tax efficiency, convert after-tax contributions to Roth status as quickly as possible to minimize taxable earnings on those funds.

For a practical example, consider Maria, who earns $150,000 in 2025 and receives a 5% employer match. She can contribute:

- $23,500 in regular 401(k) contributions

- $7,500 employer match (5% of salary)

- Up to $38,000 in after-tax contributions

- Total: $69,000 across all contribution types

By utilizing this strategy, Maria can effectively contribute nearly three times the standard limit to retirement accounts in 2025, dramatically accelerating her path to financial independence.

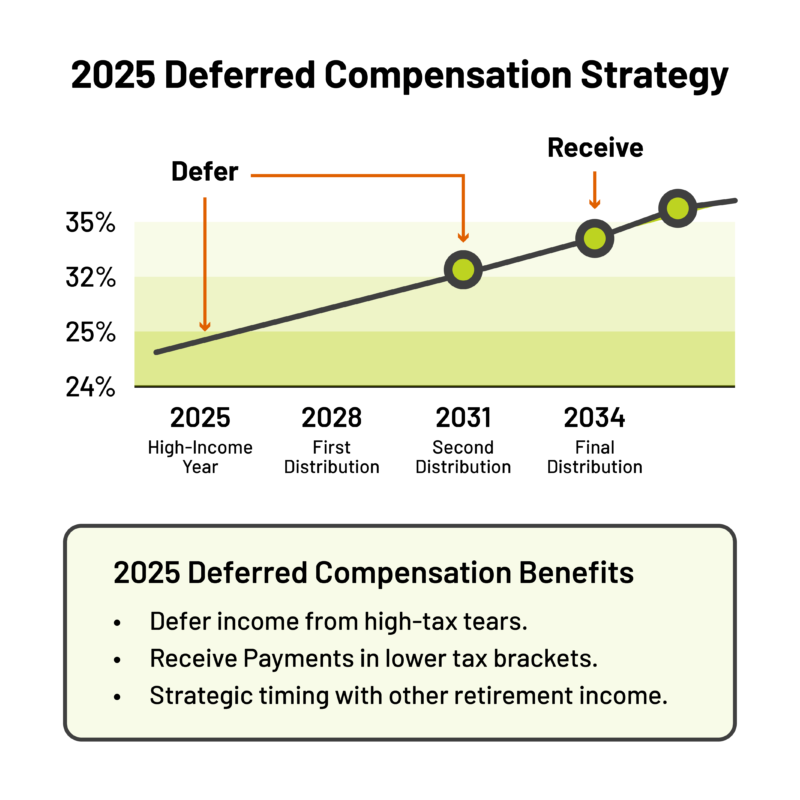

- Deferred Compensation and Executive Savings: Advanced Tax Planning for 2025

For executives and high-income professionals, specialized deferred compensation arrangements offer powerful tax planning opportunities beyond standard retirement accounts. These sophisticated strategies allow you to strategically postpone receiving a portion of your compensation until future years—potentially when you're in a lower tax bracket.

Navigating 457(f) Plans and Executive Benefits in 2025

Nonqualified deferred compensation plans, particularly 457(f) plans for non-profit executives, provide a mechanism to defer compensation well beyond the limits of qualified retirement plans. Unlike standard retirement accounts, these arrangements represent an unsecured promise from your employer to pay you in the future, trading some security for substantial tax flexibility.

For 2025, key considerations for these plans include:

| Plan Type | Eligibility | 2025 Limits | Key Risk Factors |

|---|---|---|---|

| 457(b) Plans | Government & non-profit employees | $23,500 +$7,500 (age 50+) |

Generally lower risk; separately held from employer assets |

| 457(f) Plans | Key executives at non-profits | Unlimited | Subject to "substantial risk of forfeiture"; employer credit risk |

| NQDC Plans | Corporate executives | Unlimited | Unsecured creditor; potential for employer bankruptcy risk |

| SERP | Select executive group | Plan-specific | Typically tied to performance metrics and tenure requirements |

Contribution limits Source:IRS

The strategic advantage of these plans comes from their flexibility in timing distributions. By carefully structuring when you receive deferred compensation, you can minimize your lifetime tax burden while creating predictable income streams for specific life phases—such as bridge income before Social Security begins or supplemental funds for early retirement.

For 2025, optimal deferred compensation strategies typically include:

- Strategic election timing: Make deferral elections during peak earning years when you expect to be in the highest tax brackets.

- Distribution scheduling: Plan distributions for years when you anticipate lower income, such as early retirement years before required minimum distributions begin from other accounts.

- Coordinated tax bracket management: Structure distributions to "fill up" lower tax brackets in retirement without pushing into higher brackets when combined with other income sources.

- Careful risk assessment: Balance the tax advantages against the inherent credit risk of these plans, as your deferred compensation typically remains subject to the claims of your employer's creditors.

For example, a hospital executive earning $400,000 in 2025 might defer $100,000 into a 457(f) plan, scheduling distributions for 2028-2030 when she plans to work part-time before full retirement. This approach could potentially drop her from the 35% federal tax bracket to the 24% bracket on the deferred amounts, creating substantial tax savings while providing income during her transition to retirement.

Bringing It All Together: Your Integrated 2025 Financial Strategy

The nine strategies we've explored represent a comprehensive approach to financial optimization for 2025. While each strategy offers significant benefits individually, their real power emerges when implemented together as part of a cohesive financial plan.

2025 Financial Strategy Priority Matrix

| Financial Goal | Key Strategies | 2025 Priority Level | Income Range Relevance |

|---|---|---|---|

| Build Security | Emergency Fund Debt Elimination |

Highest | All income levels |

| Tax Optimization | HSA 401(k) Match Roth Strategies |

Highest | $50K-$400K+ |

| Wealth Acceleration | After-Tax 401(k) ESPP Deferred Compensation |

Medium-High | $100K-$400K+ |

| Long-Term Growth | Optimized Asset Allocation Fee Minimization |

Ongoing | All income levels |

Your 2025 Financial Action Steps

Here's how to implement these strategies systematically in 2025:

- Financial foundation (Q1 2025):

- Build/complete emergency fund to cover 3-6 months of expenses

- Create aggressive paydown plan for high-interest debt

- Review and optimize insurance coverage

- Tax-advantaged savings maximization (Throughout 2025):

- Capture full employer 401(k) match

- Maximize HSA contributions early in year

- Implement Backdoor Roth strategy if income exceeds limits

- Advanced strategy implementation (Mid-2025):

- Evaluate eligibility for after-tax 401(k) contributions

- Analyze potential benefits of deferred compensation

- Review ESPP participation and selling strategy

- Year-end optimization (Q4 2025):

- Tax-loss harvesting in taxable accounts

- Consider Roth conversion opportunities

- Review asset allocation and rebalance if needed

Comprehensive Financial Transformation in 2025

Let’s look at how these strategies transformed the financial outlook for Jason and Maria, a professional couple earning a combined $250,000 in 2025:

Starting Position:

- $18,000 emergency fund (3 months expenses)

- $22,000 in credit card and auto loan debt (average 8% interest)

- 401(k) contributions of 6% each (receiving full employer matches)

- No HSA contributions despite eligible health plans

- Basic investment strategy without clear tax optimization

Over 12 months, they implemented each strategy systematically:

- Emergency fund: Increased to $36,000 (6 months)

- Debt elimination: Paid off all high-interest debt

- Employer benefits: Maintained 401(k) contributions with full match

- HSA optimization: Maximized family HSA contributions ($8,300)

- ESPP: Jason’s company offered an ESPP with a 15% discount; he contributed 10% of salary

- Retirement maximization: Both maximized 401(k) contributions ($23,500 each)

- Backdoor Roth: Implemented for both spouses ($7,000 each)

- After-tax 401(k): Maria’s plan allowed after-tax contributions; added $20,000

- Tax planning: Implemented strategic tax-loss harvesting in taxable accounts

The Results:

- Net worth increased by $145,000 in just 12 months

- Tax liability reduced by approximately $14,800

- Projected retirement readiness date advanced by 3.5 years

- Financial stress significantly decreased through structured planning

Taking Action: Your 2025 Financial Success Blueprint

Creating financial success isn't about perfect timing or complex schemes—it's about implementing proven strategies consistently over time. As we navigate 2025's economic landscape, remember these core principles:

- Start with protection: Build your emergency fund and eliminate high-interest debt to create financial stability.

- Capture guaranteed returns: Maximize employer matches and benefits before pursuing other investments.

- Optimize tax efficiency: Structure your investments to minimize tax drag through strategic account usage (HSAs, Roth strategies, etc.).

- Build wealth systematically: Once fundamentals are in place, implement advanced strategies like after-tax contributions and deferred compensation.

- Maintain perspective: Focus on long-term results rather than short-term market movements or economic headlines.

The financial strategies outlined for 2025 provide a comprehensive framework that adapts to your unique situation. Whether you're focused on building basic financial security or implementing advanced tax optimization techniques, these approaches offer a clear path to enhancing your financial well-being.

Remember that consistency trumps perfection. Small improvements applied regularly transform your financial trajectory over time. Your future financial self will thank you for the strategic steps you implement today.

Which of these strategies will you prioritize in your 2025 financial plan? I'm here to help you develop a targeted implementation approach based on your specific financial situation and goals.