Understanding the SECURE Act 2.0: A Financial Advisor’s Guide

It is important to understand the SECURE Act 2.0 and how it can shape your retirement planning strategy. This significant legislation, signed into law on December 29, 2022, introduces many changes that can benefit your financial future. Let’s break down the key components and what they mean for you.

What is the SECURE Act 2.0?

The SECURE Act 2.0 (Setting Every Community Up for Retirement Enhancement) builds upon the original SECURE Act of 2019. This comprehensive legislation aims to make retirement savings more accessible and flexible for Americans across various income levels and career stages.

Think of this legislation as a toolkit with new options to build your retirement security. Each provision serves as a different tool that might be useful depending on your specific financial situation.

Core Principles Behind the Legislation

Before diving into specific provisions, it’s important to understand the guiding principles that shaped SECURE 2.0:

- Expanding Access to Retirement Plans: Making it easier for more Americans to participate in employer-sponsored retirement plans.

- Increasing Savings Rates: Providing incentives and mechanisms to help people save more for retirement.

- Creating More Flexibility: Acknowledging that retirement planning isn’t one-size-fits-all and offering more options to customize your approach.

- Addressing Longevity Risk: Helping ensure that retirement savings last throughout longer lifespans.

These principles manifest in various ways throughout the legislation, creating opportunities for virtually every American to enhance their retirement readiness.

Key Changes That Impact Your Retirement Planning

- Mandatory Automatic Enrollment

Starting in 2025, new 401(k) and 403(b) plans must automatically enroll participants. This means:

- Initial contribution rates will be between 3% and 10% of your salary

- Contributions will automatically increase by 1% annually until reaching at least 10%

- You can opt-out if you choose

This change addresses one of the biggest retirement planning hurdles: getting started. Many people delay saving simply because taking that first step requires making an active decision.

- Enhanced Catch-Up Contributions

The SECURE Act 2.0 significantly increases catch-up contribution limits, especially for older workers:

| Age Group | Previous Catch-Up Limit | New Catch-Up Limit | Effective Date |

|---|---|---|---|

| 50+ | $7,500 (2023) | Indexed to inflation | Ongoing |

| 60-63 | $7,500 (2023) | $10,000 or 150% of standard catch-up amount, whichever is greater | 2025 |

Source: IRS

Real-World Example: Maria is 62 and earning $150,000 annually. Before SECURE 2.0, her maximum 401(k) contribution would be $30,000 ($22,500 standard limit plus $7,500 catch-up). In 2025, she can contribute $32,500 or more, potentially adding thousands of additional dollars to her retirement savings.

The Compound Impact of Additional Contributions: These enhanced catch-up provisions can have a substantial impact over time. Let’s analyze Maria’s situation more deeply:

- If Maria contributes an extra $5,000 annually from age 60-63 (total of $20,000 additional)

- Assuming a 7% annual return

- By age 70, just those extra contributions could grow to approximately $39,000

- If she doesn’t need to tap those funds until age 75, they could reach $55,000

This demonstrates how even relatively short-term additional contributions during your 60s can significantly impact your retirement security.

- New Roth Contribution Options

The SECURE Act 2.0 expands Roth contribution options in several meaningful ways:

- Employer Matching in Roth Accounts: Previously, employer matches were always pre-tax. Now, you can choose to have these contributions go into your Roth account.

- Mandatory Roth Catch-Up Contributions for High Earners: Beginning in 2024, individuals earning over $145,000 must make catch-up contributions to Roth accounts rather than pre-tax accounts.

- SEP and SIMPLE Roth Options: For the first time, small business retirement plans like SEPs and SIMPLE IRAs can include Roth options.

Strategic Consideration: While Roth contributions don’t reduce your current taxable income, they offer tax-free growth and withdrawals in retirement. This creates valuable tax diversification.

Tax Bracket Analysis for Roth Decisions: Your current and projected future tax brackets should guide your Roth strategy:

| Current Tax Bracket | Projected Retirement Tax Bracket | Recommendation |

|---|---|---|

| 12% or lower | Same or higher | Strong case for Roth |

| 22%-24% | Lower | Traditional may be preferable |

| 22%-24% | Same or higher | Consider split between Roth and Traditional |

| 32% or higher | Similar | Traditional may be preferable for catch-up |

| 32% or higher | Significantly lower | Traditional likely preferable |

The Case for Tax Diversification: Having both traditional and Roth accounts provides flexibility to manage your tax situation in retirement. You can strategically withdraw from either account type based on your tax situation each year.

- Required Minimum Distribution (RMD) Age Increase

The age when you must begin taking RMDs continues to rise:

| Year | RMD Age |

|---|---|

| Before 2020 | 70½ |

| 2020-2022 | 72 |

| 2023-2032 | 73 |

| 2033 and beyond | 75 |

Source: IRS

Why This Matters: This change gives your retirement savings more time to grow tax-deferred or tax-free (in the case of Roth accounts).

Long-Term Planning Impact: Delaying RMDs for an additional three years (from age 72 to 75) allows for significant additional tax-deferred growth. For example, a $500,000 IRA growing at 6% annually would increase to approximately $595,000 during those three years—nearly $100,000 in additional potential growth without required distributions.

Roth Conversion Window: This extended timeframe before RMDs begin creates a larger window for strategic Roth conversions, potentially allowing you to convert more of your traditional IRA assets to Roth before mandatory distributions begin.

Explaining the Growth Differential: By age 75, we see approximately a 35% difference in account value between the “Before SECURE 2.0” and “With SECURE 2.0” scenarios. This substantial gap stems from:

- Additional Contributions: The enhanced catch-up provisions allowing more money to enter the account

- Extended Growth Period: The delayed RMD age allowing funds to remain invested longer

- Compounding Effects: These additional dollars growing tax-deferred for several more years

The Power of Small Changes: This illustration demonstrates how relatively modest adjustments to contribution limits and distribution requirements can create substantial long-term impacts through the power of compounding.

Case Study: Strategic Tax Planning Under SECURE 2.0

Let’s examine how these changes might affect someone like Lisa, a 45-year-old software developer making $175,000 per year.

Lisa’s Strategic Roth Conversion

Lisa has $400,000 in her traditional 401(k). Based on the SECURE 2.0 provisions, she decides to:

- Convert $100,000 of her traditional 401(k) to a Roth account at age 46

- Pay the taxes on the conversion from her non-retirement savings

- Direct future catch-up contributions (once she reaches age 50) to Roth accounts

- Maximize her contributions during ages 60-63 using the enhanced catch-up provisions

Key Benefits for Lisa:

- Tax Diversification: She’ll have both pre-tax and after-tax money in retirement, giving her flexibility to manage her tax situation year by year.

- Protection Against Tax Rate Increases: If tax rates rise in the future, her Roth money will be fully protected.

- No Required Minimum Distributions: Roth accounts aren’t subject to RMDs, giving her more control over her withdrawals.

- Tax-Free Growth: All growth in her Roth account will be completely tax-free.

The Tax Cost Analysis: Let’s examine the numbers more closely:

- $100,000 Roth conversion at age 46

- Assuming she’s in the 32% federal tax bracket

- State tax of approximately 5%

- Total tax cost: Approximately $37,000

While $37,000 is a significant immediate tax cost, let’s consider the potential long-term benefit:

- That $100,000 grows to $515,000 by age 65 (as shown in the chart)

- All of that growth ($415,000) is completely tax-free

- If withdrawn from a traditional account at a 25% effective tax rate, the tax would be approximately $128,750

- Net tax savings: Approximately $91,750 ($128,750 – $37,000)

Lisa pays taxes now for significant tax benefits later, which makes sense given her long time horizon until retirement and her belief that tax rates may increase.

Navigating the Pitfalls and Maximizing Opportunities

While the SECURE Act 2.0 creates many new opportunities, there are potential pitfalls to avoid:

For High Earners: Managing the Roth Catch-Up Requirement

If you earn more than $145,000, your catch-up contributions must go to a Roth account starting in 2024. This means:

- You’ll lose the current-year tax deduction for these contributions

- You need to plan for the additional tax liability

Strategic Planning Approach:

- Adjust your tax withholding to account for the higher taxable income

- Consider other tax deductions to offset the increase in taxable income

- Evaluate the long-term benefit of tax-free growth against current tax costs

Tax Planning Technique: If your income fluctuates year to year, you might strategically time larger traditional pre-tax contributions in years when your income exceeds the $145,000 threshold, effectively reducing your income to potentially avoid the mandatory Roth catch-up provision.

For Mid-Career Professionals: Making Employer Match Decisions

With the new option to receive employer matches as Roth contributions, you’ll need to decide:

- Whether to pay taxes now on the match (Roth option) or later (traditional option)

- How this fits into your overall tax strategy

Key Consideration: Your current tax bracket versus your expected retirement tax bracket should drive this decision.

Long-Term Analysis: While paying taxes now on employer matches means a higher current tax bill, the long-term benefits can be substantial:

- All future growth on the match is tax-free

- Creates greater tax diversification for retirement

- Provides hedge against future tax rate increases

For Those Nearing Retirement: RMD Planning

With RMD ages increasing, you have more flexibility in your withdrawal strategy:

- You can leave money in your tax-advantaged accounts longer

- This affects your overall withdrawal sequence strategy

Strategic Planning Approach:

- Revisit your retirement income plan to account for the additional years of tax-deferred growth

- Consider strategic Roth conversions during the extra years before RMDs begin

- Develop a year-by-year withdrawal strategy that optimizes your tax situation throughout retirement

The Roth Conversion Sweet Spot: The years between retirement and when RMDs begin can be ideal for Roth conversions because:

- Your income may be lower after stopping work

- You have more control over your tax bracket

- Converting during these years can reduce future RMDs

Practical Implementation: A Step-by-Step Approach

Based on the SECURE Act 2.0 provisions, here’s a practical framework to enhance your retirement planning:

- Assess Your Current Retirement Savings

Start by taking stock of where you stand today:

- Current retirement account balances

- Contribution rates

- Tax characteristics of your accounts (pre-tax vs. after-tax)

- Gap between current savings and projected retirement needs

Comprehensive Assessment Questions:

- What percentage of your income are you currently saving?

- How does your current savings rate compare to the recommended 15-20% of gross income?

- What is the current balance and growth trajectory of your retirement accounts?

- How diversified are your retirement savings from a tax perspective?

Action Step: Create a retirement savings snapshot that includes all account balances, contribution rates, and tax characteristics. This baseline will help you identify specific opportunities under SECURE 2.0.

- Identify Age-Based Opportunities

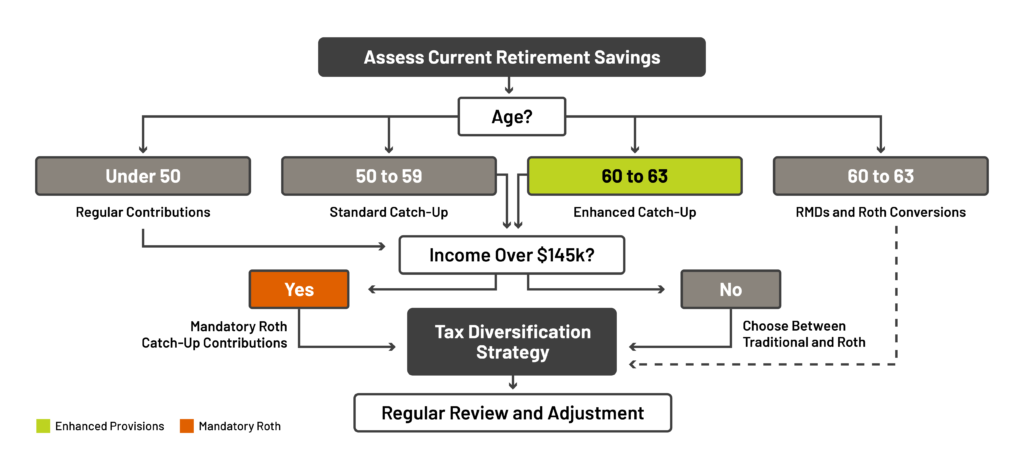

As the decision tree shows, your age significantly impacts which SECURE Act 2.0 provisions apply to you:

- Under 50: Focus on maximizing regular contributions

- 50-59: Take advantage of standard catch-up contributions

- 60-63: Leverage enhanced catch-up provisions starting in 2025

- 64+: Prepare for eventual RMDs and consider Roth conversions

Age-Specific Strategies:

- Establish a consistent contribution pattern

- Consider front-loading contributions early in the year when possible

- Evaluate whether traditional or Roth contributions are more advantageous at your current tax rate

- Maximize standard catch-up contributions

- Begin tax diversification if your portfolio is heavily weighted toward traditional or Roth

- Consider whether your savings rate needs to increase based on your retirement timeline

- Prepare to take full advantage of the enhanced catch-up provisions starting in 2025

- Evaluate whether you should adjust your planned retirement date to maximize these provisions

- Consider whether your asset allocation should be adjusted based on your timeline and the potential for these additional contributions

- Develop a comprehensive RMD strategy

- Consider Roth conversions during the window before RMDs begin

- Evaluate how the later RMD age impacts your overall retirement income plan

- Plan for Income-Based Requirements

If your income exceeds $145,000, prepare for the mandatory Roth catch-up requirement by:

- Adjusting your budget for the tax impact

- Incorporating this change into your tax planning

- Evaluating whether other tax-advantaged savings vehicles might be beneficial

Tax Planning Strategies for High Earners:

- Consider maxing out an HSA if you have a high-deductible health plan

- Evaluate whether a backdoor Roth IRA makes sense for additional tax diversification

- Look into tax-loss harvesting opportunities in taxable accounts to offset the additional tax impact

- Consider bunching charitable contributions in certain years to maximize itemized deductions

Income Reduction Strategies:

- Maximize pre-tax contributions to reduce your adjusted gross income

- Consider qualified charitable distributions if you’re over 70½

- Explore whether deferred compensation arrangements might help manage your taxable income

- Develop a Tax Diversification Strategy

Balance your retirement savings between traditional and Roth accounts:

- Traditional accounts provide current tax deductions

- Roth accounts offer tax-free withdrawals in retirement

- A mix of both gives you flexibility to manage your tax situation in retirement

The Three-Bucket Approach to Retirement Savings:

- Tax-Deferred Accounts (Traditional 401(k)/IRA): Growth is tax-deferred but taxed as ordinary income upon withdrawal

- Tax-Free Accounts (Roth 401(k)/IRA): Contributions are made with after-tax dollars, but growth and qualified withdrawals are tax-free

- Taxable Accounts: Investments that benefit from preferential capital gains tax rates

Optimal Tax Diversification Ratios: The ideal mix varies based on your situation, but consider these general guidelines:

- Lower current tax bracket (12% or below): Heavier weight toward Roth

- Middle tax brackets (22-24%): More balanced approach

- Higher tax brackets (32% and above): Potentially more emphasis on traditional, with some Roth for flexibility

Strategic Roth Conversion Ladders: Consider implementing a multi-year Roth conversion strategy where you convert portions of your traditional accounts each year, keeping the converted amount within a target tax bracket. This “conversion ladder” approach can help manage the tax impact while still moving funds to the tax-free Roth environment.

Special Topics: SECURE Act 2.0’s Impact on Small Business Owners

The SECURE Act 2.0 includes several provisions specifically designed to help small business owners establish and maintain retirement plans:

- Enhanced Tax Credits for New Plans Small businesses can receive tax credits for starting new retirement plans:

- Up to 100% of startup costs (up to $5,000) for the first three years

- Additional credit of up to $1,000 per employee for employer contributions (phased out over 5 years)

- Simplified Plan Options The legislation simplifies the process of offering retirement plans:

- Expanded pooled employer plans (PEPs) allow businesses to join together to offer plans

- Reduced administrative burdens for SIMPLE and SEP IRAs

- New Starter 401(k) plans with simplified requirements

- New Part-Time Employee Provisions (Continued)

- No requirement to make employer contributions for these newly eligible employees

- Simplified administrative procedures for handling part-time worker enrollment

- Improved Plan Design Flexibility The legislation introduces several enhancements to plan design options:

- Ability to offer emergency savings accounts linked to the retirement plan

- Simplified correction procedures for plan errors

- Expanded self-correction options for inadvertent compliance issues

Special Considerations for Women and Retirement Planning

The SECURE Act 2.0 addresses several challenges that disproportionately affect women’s retirement security:

- Career Interruption Accommodations Women often experience career interruptions for caregiving, which can impact retirement savings. SECURE 2.0 helps address this through:

- Long-term part-time worker provisions that provide retirement plan access with fewer hours

- Expanded catch-up contribution opportunities later in careers

- More flexible emergency withdrawal provisions

- Longevity Planning Support With women typically living longer than men, the later RMD age provides additional benefits:

- More time for tax-advantaged growth before mandatory withdrawals begin

- Extended window for strategic Roth conversions

- Greater flexibility in retirement income planning

- Retirement Income Security Several provisions help address income security in retirement:

- Enhanced ability to purchase qualified longevity annuity contracts (QLACs)

- New provisions supporting lifetime income options within retirement plans

- Improved portability of lifetime income products between plans

Strategic Planning Considerations for Women:

- Maximize catch-up contributions when returning to the workforce after caregiving periods

- Consider how the extended RMD age might impact long-term financial security

- Evaluate whether Roth conversions make sense given potential longevity

- Assess whether lifetime income options should be incorporated into your retirement strategy

- approaches

Final Thoughts: The True Value of the SECURE Act 2.0

As we conclude our exploration of the SECURE Act 2.0, it’s important to recognize the true significance of this legislation. Beyond the technical provisions and tax strategies, the SECURE Act 2.0 represents an important evolution in how we approach retirement security in America.

A More Accessible Retirement System

The automatic enrollment provisions, simplified plan options for small businesses, and expanded access for part-time workers all contribute to a more inclusive retirement system. These changes acknowledge that retirement security should be available to workers across the economic spectrum.

Greater Flexibility for Modern Careers

With provisions supporting student loan repayment, emergency savings, and enhanced catch-up contributions, the legislation recognizes that career paths aren’t always linear. These features provide flexibility for those with interrupted careers or competing financial priorities.

A More Personalized Approach

The expanded options for tax diversification, the later RMD age, and the various catch-up provisions allow for more customized retirement planning. This acknowledges that each person’s financial journey is unique and requires personalized solutions.

The Role of Professional Guidance

While the SECURE Act 2.0 creates many new opportunities, it also introduces greater complexity into retirement planning. Working with knowledgeable financial professionals becomes even more valuable in navigating these changes and creating strategies that align with your specific goals and situation.

Your Personal Journey

Remember that retirement planning isn’t just about numbers and tax strategies—it’s about creating the financial foundation for the life you want to live in retirement. The SECURE Act 2.0 provides new tools to help build that foundation, but the vision for what you want your retirement to look like comes from you.

The key to success lies in taking informed action based on a clear understanding of how these changes affect you personally. I’m here to help you navigate these changes and create a strategy that moves you closer to your retirement goals.