Keeping More of Your Money in Retirement: Tax Strategies Made Simple

Introduction: Strategies to Reduce Your Retirement Taxes

Many retirees are unaware of the tax traps waiting for them in retirement. Why? Because they have never drawn Social Security, been on Medicare or taken withdrawals from their retirement accounts. But don’t worry – with some forward-thinking planning, you can keep more of your hard-earned money in your pocket instead of sending it to the IRS.

I’m going to walk you through some easy-to-understand strategies that can help you pay less in taxes during retirement. These aren’t complicated tax loopholes – they’re straightforward approaches that anyone can use.

In retirement, your money typically comes from different places: Social Security, retirement accounts like 401(k)s and IRAs, and maybe some savings or investments. Each of these is taxed differently. Understanding these differences – even at a basic level – can save you thousands of dollars over your retirement years.

You don’t need to become a tax expert. Just learning a few key principles can make a big difference in how much money you have to enjoy during your retirement.

Understanding Retirement Accounts and Required Minimum Withdrawals

Two Main Types of Retirement Accounts

Let’s start with the basics. There are two main types of retirement accounts that work very differently when it comes to taxes:

Traditional IRAs and 401(k)s: These accounts give you a tax break when you put money in. For example, if you contribute $6,000 to a traditional IRA, you might reduce your taxable income by $6,000 that year, potentially saving you $1,320 if you’re in the 22% tax bracket.

Your money then grows without being taxed each year. However, when withdraw money during retirement, you’ll pay ordinary income taxes on both your original contributions and the entire growth.

Roth IRAs and Roth 401(k)s: With these accounts, you don’t receive any tax break when you contribute funds because you contribute money that’s already been taxed. The big advantage comes later: all your withdrawals in retirement – including all the investment growth – are completely tax-free.

Here’s a simple way to think about it:

| Traditional Accounts | Roth Accounts |

|---|---|

| Tax break NOW, taxes LATER | No tax break NOW, no taxes LATER |

| Like planting a seed with a discount, but sharing the harvest | Like planting a full-price seed, but keeping the entire harvest |

Having both types of accounts gives you more flexibility in retirement. It’s like having different tools in your toolbox – you can use the right one depending on your situation each year.

What Are Required Minimum Distributions (RMDs) and Why Do They Matter?

The government incentivizes you to save for retirement by giving you tax breaks for saving in traditional retirement accounts, but they don’t let you keep the money in there forever. Think of them as your silent partner in your retirement account. When you reach age 73, you must start taking money out each year from your traditional IRAs, 403(b)s, 457s and 401(k)s. These mandatory withdrawals are called Required Minimum Distributions, or RMDs.

Think of RMDs like this: imagine you’ve been growing a garden in a community plot. The government gave you a discount on seeds and gardening supplies (tax deduction), but now they want their share of the vegetables you’ve grown (taxes on withdrawals).

The amount you must withdraw each year is calculated based on your account balance and your age. As you get older, you’re required to withdraw a larger percentage.

Here’s why RMDs matter for your taxes:

- They force you to take income that’s taxed as ordinary income. Even if you don’t need the money, you must take it and pay taxes on it.

- They trigger higher taxes on your Social Security. Many people don’t realize that Social Security benefits can be taxable if your income is above certain levels.

- They could increase your Medicare premiums. If your income goes above certain thresholds, you’ll pay more for Medicare.

Let me share a simple example to show how this works:

Meet Bob and Linda. They’re retired and receive $30,000 in Social Security and have a $20,000 pension. Without RMDs, they’re in the 12% tax bracket. When they turn 73, they must take a $36,500 RMD from their IRA, which pushes them into the 22% tax bracket and increases their Medicare premiums.

| Income Source | Before RMDs | After RMDs Begin |

|---|---|---|

| Social Security | $30,000 | $30,000 |

| Pension | $20,000 | $20,000 |

| IRA Withdrawal (RMD) | $0 | $36,500 |

| Total Income | $50,000 | $86,500 |

| Tax Bracket | 12% | 22% |

| Extra Taxes Paid | About $7,000 more | |

| Monthly Medicare Premium Increase | $0 | $65.90 |

That’s a big jump in taxes! But don’t worry – with some planning, you can reduce this tax hit.

The Problem With Having Too Much Money in Traditional Retirement Accounts

If you’ve saved a lot in your traditional IRA or 401(k), you might face a tax surprise when you reach 73. The more you’ve saved, the larger your required withdrawals will be.

For example, if you have $1 million in your traditional IRA at age 73, your first RMD would be about $36,500. If you have $2 million, your RMD would be about $73,000. That’s extra income must be taken and taxed whether or not you need it or want it.

Large RMDs can:

- Push you into higher tax brackets – potentially doubling your tax rate from 12% to 24% or higher

- Increase your Medicare costs – premiums can more than triple for high-income retirees

- Cause more of your Social Security to be taxed

Here’s a simplified look at how Medicare premiums increase with income in 2025:

| Annual Income (Married Filing Jointly) | Monthly Medicare Part B Premium |

|---|---|

| $194,000 or less | $174.70 |

| $194,001 to $244,000 | $244.60 |

| $244,001 to $306,000 | $349.40 |

| Over $306,000 | $454.20 or more |

Those premium increases will be assessed on both spouses, so you can double the extra IRMAA surcharges. See our blog on Medicare to learn more. As you can see, if your RMDs push your income over these thresholds, you’ll pay significantly more for healthcare in retirement.

Simple Strategies to Lower Your Retirement Taxes

Smart Ways to Withdraw From Your Retirement Accounts

One of the easiest ways to manage your taxes in retirement is being smart about from which accounts withdraw money from each year.

Think of your different retirement accounts like different buckets of water. Some buckets (traditional accounts) have water that will be taxed when you use it. Other buckets (Roth accounts) have water that’s already been taxed and is free to use.

Here’s a simple approach:

- First, figure out how much money you need for the year

- Take your required withdrawals (RMDs) first, since these are mandatory

- If you need more money and are in a low tax bracket, take more from your traditional accounts

- If taking more from traditional accounts would push you into a higher tax bracket, take from your Roth accounts instead

Let’s see how this works with an example:

Sarah and Mike need $60,000 for living expenses this year. They receive $25,000 from Social Security and have a $35,000 RMD from their traditional IRA. This puts them in the 12% tax bracket, which in 2025 goes up to $89,450 for married couples.

Since they’re not close to the next tax bracket, they could actually withdraw up to $29,000 more from their traditional IRA and still pay only 12% in taxes on that money. This is a great opportunity to either:

- Take extra money for a special purchase or travel

- Convert some traditional IRA money to a Roth IRA (more on this later)

If they needed even more money – say another $20,000 for a home renovation – they could take that from their Roth IRA without increasing their tax bill at all.

This approach requires some planning each year, but it can save you thousands in taxes over your retirement.

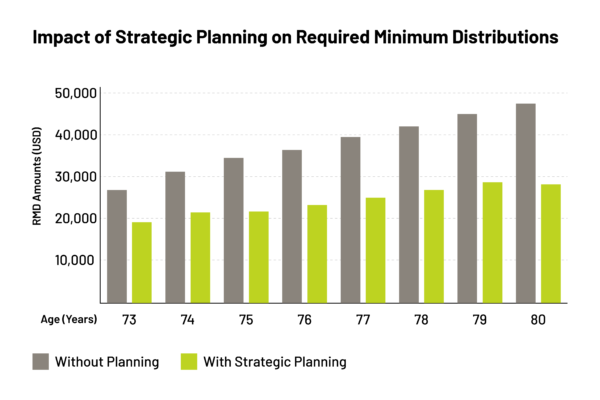

Planning Ahead to Reduce Your Required Withdrawals

You don’t have to wait until age 73 to start taking money from your traditional IRA. In fact, starting earlier can be a smart tax move for many people.

By taking smaller withdrawals before RMDs kick in, you can:

- Reduce your traditional IRA balance, which lowers future RMDs

- Spread out your tax burden over more years

- Potentially stay in lower tax brackets throughout retirement

Here’s a simple comparison to show how this works:

| Strategy | Wait Until RMDs | Start Early Withdrawals |

|---|---|---|

| Age 65-72 withdrawals | $0 per year | $40,000 per year |

| Total withdrawn before RMDs | $0 | $320,000 |

| IRA balance at 73 | $1,300,000 | $900,000 |

| First year RMD | $47,445 | $32,847 |

| Tax situation | Pushed into 22% bracket | Stays in 12% bracket |

| Tax savings over 10 years | $0 | About $63,000 |

Another powerful strategy is converting some of your traditional IRA to a Roth IRA. This means you pay taxes on the money now, but all future growth will be tax-free, and you won’t have RMDs on that money.

This is like paying the tax bill on your garden now, so you can enjoy all the vegetables tax-free later – and you won’t be forced to harvest them on the government’s schedule.

The best time to do conversions is often in the years right after you retire (when your income might be lower) but before RMDs begin at age 73.

Making the Most of Your Early Retirement Years

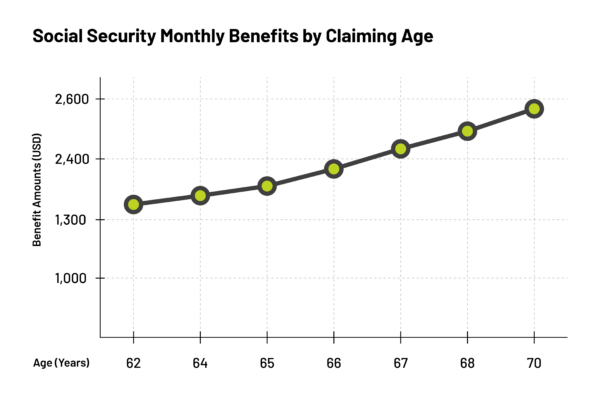

The “Gap Years” Strategy: A Special Tax-Planning Opportunity

The period between when you retire and when you start taking Social Security is sometimes called your “gap years.” This time is golden for tax planning.

One strategy to consider is delaying Social Security until age 70. This increases your monthly benefit by about 8% for each year you wait past your full retirement age. Here’s how the numbers might look:

| Age When Starting Social Security | Monthly Benefit | Annual Benefit |

|---|---|---|

| 62 (early) | $1,400 | $16,800 |

| 67 (full retirement age) | $2,000 | $24,000 |

| 70 (maximum delay) | $2,480 | $29,760 |

By waiting until 70, you get a 77% larger benefit compared to starting at 62! That’s like getting a big raise in retirement. This not only gives you more guaranteed income for life but also creates low-income years that are perfect for tax planning.

During these gap years, consider:

- Taking money from your traditional IRA, even if you don’t need it for expenses

- Converting some traditional IRA money to a Roth IRA

- Selling investments with large gains (you might qualify for a 0% capital gains tax rate)

Let me share an example:

Tom and Janet retired at 62 but decided to wait until 70 to claim Social Security. During those eight years, they took $30,000 annually from their traditional IRA for living expenses and converted another $20,000 each year to a Roth IRA.

They only paid 12% in taxes on these withdrawals and conversions. By age 70, they had moved $160,000 to Roth accounts and reduced their traditional IRA balance by $400,000 total. This significantly lowered their future RMDs and created a source of tax-free income.

Taking Advantage of Low-Income Years to Save on Capital Gains Taxes

Here’s something many retirees don’t know: if your taxable income is low enough, you might pay 0% tax on long-term capital gains (profits from investments held longer than a year).

In 2025, married couples with taxable income below $94,050 (or single filers below $47,025) pay no federal tax on long-term capital gains.

This creates a great opportunity during your gap years when your income might be lower. You can sell appreciated investments and pay little or no tax on the gains.

For example, if your taxable income is $70,000, you could sell stocks with up to $24,000 in gains and pay zero federal tax on those gains. If you waited until your income was higher (perhaps due to RMDs or Social Security), you might pay 15% or even 20% on those same gains.

Think of it this way: If you have stocks that have grown a lot, you’ll have to pay taxes on that growth eventually when you sell them. Selling during low-income years can mean paying no tax instead of 15% or 20% later.

This strategy allows you to:

- Update your investment portfolio without a big tax bill

- Diversify concentrated stock positions

- “Reset” your investment cost basis (which can save taxes for your heirs)

Please see our blog on [Tax Loss Harvesting] to learn how to minimize capital gains in the future.

Timing Your Income and Expenses for Maximum Tax Advantage

Another simple but powerful strategy is carefully timing when you receive income and when you take deductions:

Income Acceleration: Taking more income during low-tax years

- Converting traditional IRAs to Roth IRAs

- Selling investments with gains

- Taking larger IRA distributions than needed for expenses

Expense Postponement: Saving deductions for high-income years

- Grouping charitable donations into years when you have higher income

- Timing major medical expenses when possible

- Delaying property tax payments when it makes sense

Here’s a simple example:

| Strategy | Low-Income Year (12% bracket) | High-Income Year (22% bracket) | Tax Savings |

|---|---|---|---|

| Take an extra $30,000 from IRA in low-income year | $3,600 tax | Would have been $6,600 | $3,000 |

| Delay $15,000 in charitable donations until high-income year | $0 tax benefit | $3,300 tax benefit | $3,300 |

| Total Tax Savings | $6,300 |

By being strategic about when you receive income and take deductions, you can save thousands in taxes over your retirement years.

Special Situations in Retirement Tax Planning

Still Working After 73? You Might Be Able to Delay Some RMDs

If you’re still working at age 73, you might be able to delay taking RMDs from your current employer’s retirement plan (like a 401(k)). This rule is sometimes called the “still working exception.”

This exception applies if:

- You’re still working for the employer (even part-time counts)

- You own 5% or less of the company

- Your plan allows this delay

Important things to know:

- This only applies to your current employer’s plan

- You must still take RMDs from IRAs and old employer plans

- You’ll need to take your first RMD by April 1 of the year after you retire

For example, if you’re still working at 73 and have $500,000 in your current employer’s 401(k), you wouldn’t have to take RMDs from that account until you retire. This could save you thousands in taxes each year you continue working.

Some people even roll their IRA money into their current employer’s plan (if the plan allows it) before turning 73, which lets them delay RMDs on that money too.

Putting It All Together: A Simple Roadmap for Retirement Tax Planning

A Lifetime Approach to Minimizing Taxes in Retirement

Putting all these strategies together gives you a simple roadmap for managing taxes throughout retirement:

- Before retirement: Build flexibility for later

- Save in both traditional and Roth accounts

- Build some regular savings/investment accounts

- Consider your future income needs and tax situation

- Early retirement (before RMDs): Use your lower-income years wisely

- Consider delaying Social Security to age 70

- Take strategic withdrawals from traditional accounts

- Convert some traditional IRA money to Roth IRA

- Sell investments with large gains at lower tax rates

- Middle retirement (age 73+): Manage your required distributions

- If you’re charitably inclined, donate directly from your IRA

- Balance withdrawals between traditional and Roth accounts

- Time your income and deductions strategically

- Throughout retirement: Stay flexible and review annually

- Tax laws change, so review your strategy periodically

- Adjust your approach as your needs and tax situation change

- Consider working with a tax professional for personalized advice

For most retirees with $500,000 to $2 million in retirement savings, these strategies can save $50,000 to $150,000 in taxes over their retirement lifetime. That’s money that stays in your pocket rather than going to the IRS!

Remember that these strategies don’t require complex tax loopholes or aggressive approaches. They’re simply about being smart with the timing of your income and understanding how different types of accounts are taxed.

By taking control of your retirement tax situation with these straightforward strategies, you can enjoy your retirement years with more money to spend on the things that matter most to you.