How to Best Manage Your Beneficiary Designations

How to Best Manage Your Beneficiary Designations

Leaving an inheritance to your family or friends is not just about passing on assets, it is about making sure that your assets are distributed in the way you intend. Beneficiary decisions are part of the process to opening an account that involves money such as 401(k) plan, 403(b) plan, or an IRA account. This also applied for Life Insurance or Annuity accounts. For each of these accounts, the application includes a section to name beneficiaries for the account.

It may not have occurred to you who will inherit your money when you die, particularly if you are young. You may designate a close family member and not give it too much thought. But life goes on and people marry and start their own families, which is why it is important to review your beneficiary designations, particularly when you undergo a major life event.

Personal Life Changes

When your personal life changes, however, for example with a spouse or children, you will want for your money to go to them.

If you are married, your spouse should be listed first as the primary beneficiary. But who should be named as the contingent beneficiaries? There can be important considerations such as:

Do you have minor children?

Are they too young to inherit the funds?

Who is their guardian?

If you leave the funds to someone, how difficult is it to change the designation?

You Can Always Change Your Beneficiaries!

If you have read through this guide and are concerned that you did not select the right options for your IRA beneficiary designation, don’t worry. You can always change your beneficiaries, and it is usually as simple as submitting a new form.

Each time you change or update a 401k beneficiary, ask for a confirmation that the retirement account custodian or administrator received it. In most cases, the beneficiary designation will only be considered binding if the responsible party received it before the IRA owner dies.

How to Name Beneficiaries

Whenever you have the opportunity to designate a beneficiary, put some thought into it. If there is no named beneficiary, a probate court may decide to whom your money goes, which can delay the payout. It may not end up with the beneficiary you want. Even if you have a will, the investment provider for your 401(k) or IRA will use the beneficiary information that is on file to make a determination about where the assets should go.

Regularly Review Your Beneficiary Information. When a major life change occurs, such as marriage, a divorce, or the birth of children, it is the perfect time to re-evaluate.

beneficiary information. You may find that your beneficiary designations are outdated.

Per Stirpes vs. Per Capita

In addition to listing primary and contingent beneficiaries, estate planning best practices suggest that you indicate whether you would like your retirement account to be distributed per capita or per stirpes.

What does Per Capita Mean?

The per capita designation is usually the default option for your retirement account beneficiary. The term is Latin for “by head” and requires that all living beneficiaries receive an equal share of the retirement funds.

If you select this option and one of your beneficiaries passes away before you, their share of the inheritance will be divided equally among the remaining beneficiaries.

As a result, a portion of this money will not be set aside for the deceased beneficiary – instead, their portion will be split equally among the remaining members of the group.

Here is an example that can help you understand this further:

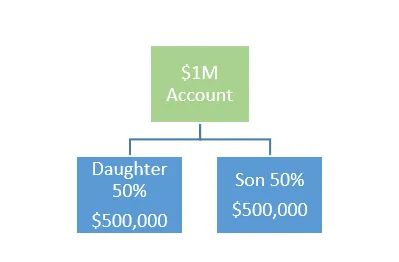

Let’s pretend you have a 401(k), and the beneficiaries are listed as your son and daughter. If they are listed as 50/50 beneficiaries, and you had $1 million in the account when you died, they would each receive $500,000.

What would happen, though, if your daughter died before you did?

In that case, under the per capita distribution, your son would receive her 50% share, which would result in him receiving an inheritance of $1 million at your death.

Your daughter’s children would not receive anything because they were not explicitly stated as a beneficiary – and the per capital rule determines that the surviving member, your son, will receive a pro-rata portion of her share.

Let’s look at a more complicated example:

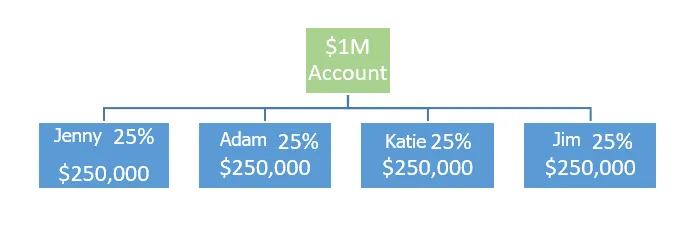

In this example, we’ll assume you have your four kids, Sarah, Nicole, Jake, and Bob. They are listed as your primary beneficiaries for your $1 million 401k account that will be distributed per capita.

If they all survive you, upon your death, the account will be split equally into four parts. Sarah, Nicole, Jake, and Bob will each receive 25% of your retirement account – or $250,000 each.

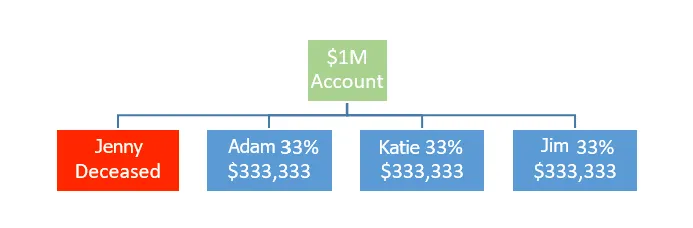

If Sarah passed away before you, the other three children will receive an equal share of her portion. Sarah and her heirs will not receive anything, but Nicole, Jake, and Bob will receive an equal portion of her 25%. This results in the surviving children inheriting 33% of your 401k, or $333,333 apiece.

As you can see, per capita distribution does not address the fact that Sarah’s spouse and children will not receive any of the funds left in your IRA, even if that was the intention in your will!

How is Per Stirpes Distribution Different?

So, let’s assume you don’t like how the per capita distribution may affect your grandchildren. You have another option, per stirpes

.

Per stirpes is a Latin term that translates to “by class” or “by representation.” Rather than grouping the beneficiaries by the person, it looks at each living beneficiary as a class of people that will receive an equal share.

To put this in layman’s terms, if one of your beneficiaries dies before you do, their children or immediate relatives will inherit their portion of funds from your 401(k) instead. This option ensures that the share of funds you designated to this person will always go to them or their heirs.

The thinking with this designation is that you would have wanted the deceased beneficiary to have access to those funds to support their family and lifestyle – so why shouldn’t their heirs receive it if they can’t?

The flow chart below shows that even though your daughter died before you do, her 50% portion of your retirement account does not automatically go to your son. Instead, her daughter – your granddaughter – will receive the half that you intended her to inherit.

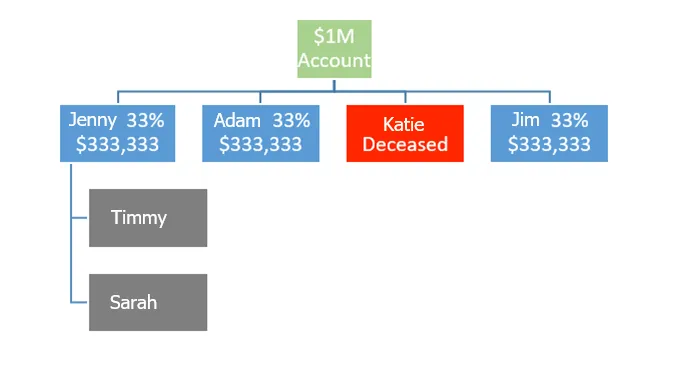

Sometimes life can be more complex, so let’s look at the per stirpes beneficiary distribution process in a more complicated scenario.

Here you have your four children, Sarah, Nicole, Jake, and Bob, getting an equal share of your 401k account. None of your children have kids except for Sarah, who has two sons: Johnny and Billy.

If Sarah passes away before you, her share does not get evenly distributed to your other children. Instead, your grandsons Johnny and Billy will split her 25% allocation, leaving them with $125,000 – or 12.5% – each.

Now, let’s look at a similar situation, but instead of Sarah predeceasing you, we will assume that Jake did. Jake had no children, so there is no one else to take on his share of the retirement account. The result is that the surviving children, Sarah, Nicole, and Bob, inherit his portion of the funds.

Per stirpes beneficiary designations allow you to address all aspects of your family situation in advance so that you do not have to alter your estate planning documents each time a new grandchild is born, or an original beneficiary passes away.

Is Per Stirpes or Per Capita Right for Me?

There is no right or wrong answer. Everyone’s situation is unique. Whatever you decide, don’t leave this to chance! Making a thoughtful decision when naming beneficiaries is an important part of your financial planning foundation and flows right into proper estate planning. Your designations should be reviewed annually at a minimum, or at any time you experience a major life change.

Your best bet may be to partner with a financial planning expert that can help you thoroughly analyze your situation and determine the best course of action.

Taxes Due on Retirement Accounts

Many retirement accounts are tax-deferred investments, meaning that income taxes are due when money is withdrawn. If young children are the designated beneficiaries, trusts may need to be set up. In these cases, a trust can be named as beneficiary, but the taxes could be due all at once. If the children are younger, funds must be pulled from the retirement account within 10 years of reaching the age of majority, usually age 18).

In 2019, the SECURE ACT changed the tax laws for inherited IRA’s and retirement accounts. For an adult over 18, non-spousal beneficiaries must withdraw the money from the account within 10 years of the death of the account owner. The money can be taken out at any time during the 10-year period but must be emptied at the 10-year mark. Formerly, non-spouse beneficiaries and trusts could take out minimum annual withdrawals over the beneficiary’s remaining life expectancy determined by the IRS.

A spouse can inherit an IRA and can assume ownership of the IRA without any tax consequences. Spouses do not have to withdraw any funds in a set time period unless they are subject to an RMD (Required Minimum Distribution) which begins at age 73.

Charitable Contributions

Another beneficiary option for your account is to leave it directly to a charity. If you would like to leave money toward a charitable organization, it is usually best to name the charity or charities as direct beneficiaries on the IRA or retirement plan. Charities are not required to pay income taxes when they receive money from an IRA or 401(k). If you choose to name a charity as beneficiary, and you are married, your spouse must agree to the designation.

Revocable Living Trust

Many people use living trust to avoid probate. A revocable living trust allows the creator of the trust to give the beneficiary the ability to make financial decisions about the money in the trust, in the event you become unable to make financial decision on your own. Many times, the revocable trust is named as the full primary beneficiary on a life insurance policy. These funds are not subject to federal or state income taxes.

Adding a Beneficiary to a Bank or Brokerage Account

Although you can’t add a beneficiary to a bank or brokerage account, it is possible to avoid probate for these accounts. You can set up a Pay-on-Death (POD) designation for the accounts, which enables the account to pass on to your POD designation upon your death. Adding this designation can be done at no charge and it can be changed at any time by you by submitting an updated form.

Echelon Financial is an independent Austin-based firm helping clients build better relationships with their money, their family, their work, and their future.

Your goals. Your values. Your life.

Our Services

Wealth Management

Tax Preparation

Bookkeeping

Contact

Address: 4201 Bee Cave Road

Suite C-101,

Austin, TX 78746

Office: 512.381.4500

Toll-Free: 1.800.796.5690

Email: info@echelonfinancial.com

Copyright © 2024 Echelon Financial. All Rights Reserved. Privacy Policy

Echelon Financial is a member firm of The Fiduciary Alliance, LLC which is an SEC registered investment adviser located in Greenville, South Carolina. Advisor and its representatives are in compliance with the current filing requirements imposed upon SEC registered investment advisers by those states in which Advisor maintains clients. Advisor may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Advisor’s web site is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Accordingly, the publication of Advisor’s web site on the Internet should not be construed by any consumer and/or prospective client as Advisor’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any testimonials or endorsements contained on this page or in videos may be given by current clients or non-clients and are not paid for. There are no conflicts of interest involved with any of those individuals' giving testimonials or endorsements.

ces