Wealth Planning Strategies for Affluent and High-Net-Worth Families in Austin

Are you managing millions in assets but still using the same financial playbook from your wealth-building years?

Today I’m sharing the advanced wealth strategies that actually work for families with significant assets in and around Austin.

If you want answers to questions like…

- How does financial planning change when you have $1M+ in investable assets?

- What tax strategies do ultra-wealthy families use that others miss?

- How can you protect your wealth from lawsuits, market volatility, and excessive taxation?

- What’s the right way to transfer wealth to the next generation?

…today’s comprehensive guide is for you!

Why Traditional Financial Advice Fails the Wealthy

If you’re managing seven or eight figures in assets, you’ve outgrown the standard financial advice that worked during your accumulation phase.

The strategies that helped you build wealth aren’t the same ones that will help you preserve, optimize, and transfer it.

Think about it: Most financial articles discuss budgeting apps, maxing out your 401(k), or when to claim Social Security. But when your net worth reaches $1 million, $5 million, or $25 million, these basics barely scratch the surface of what you need.

At this level, financial planning becomes about:

- Protecting a complex balance sheet

- Coordinating multiple financial strategies

- Optimizing for tax efficiency

- Structuring assets for multi-generational wealth

- Safeguarding against increased liability exposure

As your wealth grows, so does the complexity of your financial ecosystem. What used to be a retirement account and brokerage account may now include:

- Multiple investment accounts with varied tax implications

- Business interests or a real estate portfolio

- Trusts for children or grandchildren

- Significant charitable or philanthropic interests

Let’s dive into how planning changes based on your wealth level.

Understanding Wealth Tiers: Where Do You Fit?

The financial industry classifies wealth in tiers that determine what strategies apply to your situation:

Here’s what these classifications mean for your planning:

| Wealth Tier | Asset Range | Primary Planning Focus | Key Strategies |

|---|---|---|---|

| Affluent | $250K-$999K | Accumulation & Growth | Tax-efficient savings, Basic estate planning, Income protection |

| High-Net-Worth | $1M-$9.9M | Preservation & Optimization | Tax minimization, Multi-account investments, Trust planning |

| Ultra-High-Net-Worth | $10M+ | Legacy & Multi-generational Transfer | Advanced estate structures, Family office, Philanthropic vehicles |

These aren’t just labels—they define the strategies available to you, the investments you’re eligible for, and even which advisors can properly serve your needs.

Let me be clear: The strategies that work for someone saving their first $250,000 will NOT effectively serve someone managing $5 million, let alone $25 million.

More wealth brings more opportunity, but also more complexity and risk. Let’s examine what this means for each aspect of your financial life.

- Investment Management: Beyond the 60/40 Portfolio

If your investable assets have crossed the $1 million mark, your investment strategy needs to evolve. This is where wealth shifts from being accumulated to being managed—with precision.

Why Your Investment Strategy Must Scale With Your Wealth

Traditional investment advice centers around the classic 60/40 stock-bond allocation. That’s fine for growing modest wealth, but once you cross into high-net-worth territory, it no longer provides the flexibility, efficiency, or protection you need.

At the high-net-worth level, you can incorporate tools and strategies previously available only to institutions:

- Private placements for access to emerging companies and potentially higher long-term returns

- Real Estate to take advantage of investing in commercial real estate for diversification

- Municipal bonds that provide federally tax-free income (and state tax-free if you invest in Texas munis)

- Structured notes that can offer downside protection or enhanced yield based on market outcomes

Here’s how investment complexity changes across asset levels:

| Investor Type | Typical Portfolio | Advanced Tools | What’s Different |

|---|---|---|---|

| Mass Affluent ($250K-$999K) | Index funds, IRAs, 401(k)s | Basic asset allocation, Periodic rebalancing | Focus on accumulation and dollar-cost averaging |

| HNW ($1M-$10M) | Diversified equities, Muni bonds, Alternative investments | Tax location strategies, Private equity access, Donor-advised funds | Emphasis on tax efficiency and custom allocation |

| UHNW ($10M+) | Institutional-grade alternatives, Direct investments, Custom solutions | Family office structures, Custom investment policy, Alternative beta strategies | Complete customization and institutional-level access |

Bottom line: Once your portfolio reaches seven figures, investment management isn’t just about investing more—it’s about investing smarter and with intention.

- Tax Planning: Your Biggest Expense to Manage

For most of our high-net-worth clients in Austin, taxes represent their single biggest expense every year. We routinely see families paying:

- Over 37% on ordinary income

- Up to 23.8% on long-term capital gains (including the Net Investment Income Tax)

- A 40% estate tax on wealth passed above the federal exemption level

When you’re in the top tax brackets, tax planning isn’t a once-a-year exercise—it’s an all-year strategy that touches every part of your financial life.

Advanced Tax Strategies for High-Net-Worth Individuals

| Strategy | How It Works | Potential Tax Savings |

|---|---|---|

| Asset Location | Place tax-inefficient investments in tax-advantaged accounts | 0.5-1% annual after-tax return improvement |

| Tax-Loss Harvesting | Strategically realize losses to offset gains | Up to $3,000 against ordinary income plus unlimited offset against capital gains |

| Qualified Small Business Stock (QSBS) | 100% exclusion from federal tax on eligible small business stock | Up to $10M or 10x your investment tax-free |

| Charitable Remainder Trusts | Convert highly appreciated assets into lifetime income | Upfront deduction plus elimination of immediate capital gains |

Case Study: The $2.3 Million Tax Save

We recently worked with an Austin entrepreneur who sold his business for $20 million. By structuring his ownership as Qualified Small Business Stock (QSBS) under IRC Section 1202, we helped him exclude $10 million of that gain from federal taxes.

How did we do this? We:

- Verified his C-corporation had less than $50 million in assets

- Confirmed he’d held the stock for over 5 years

- Properly documented the original issuance of shares

- Structured the sale to qualify for the 100% exclusion

That single decision saved him over $2.3 million in federal tax—money that now powers his family foundation.

Tax Coordination: Why In-House Tax Planning Matters

Most financial advisors don’t have CPAs on staff. That means their tax recommendations are theoretical, not practical—and you’re left trying to coordinate between advisors who might have competing objectives.

As a boutique firm with integrated wealth management and tax expertise, we build tax strategy directly into your financial plan. This gives you a seamless experience where tax decisions align with your investment, estate, and retirement strategies from day one.

Bottom line: The higher your income and wealth, the more essential proactive tax planning becomes. It’s often more impactful than investment selection itself.

- Retirement Planning: Beyond the “Magic Number”

For affluent and high-net-worth families, retirement isn’t just a question of “when can I stop working?”—it’s a series of decisions about how to make your wealth last, how to access it in the most tax-efficient way, and how to protect it across decades.

At this level, you’ve likely accumulated enough to retire comfortably. The real challenge is making your money work smartly across a 30- to 40-year span.

Retirement Planning Evolved: The Three-Bucket Strategy

Traditional retirement planning focuses on a single portfolio with a “safe” withdrawal rate. For high-net-worth individuals, we use a more sophisticated “bucket” approach:

| Bucket | Time Horizon | Purpose | What Goes Here |

|---|---|---|---|

| Short-Term | 1-2 years | Immediate spending needs | Cash, Money market, Short-term bonds |

| Mid-Term | 3-10 years | Intermediate income replacement | Fixed income, Dividend stocks, REITs |

| Long-Term | 10+ years | Growth and legacy | Equities, Private equity, Legacy assets |

This strategy allows for:

- Protection from having to sell during market downturns

- Tax optimization based on market conditions

- Strategic Roth conversions in the early retirement years

- Clear separation of spending money from growth assets

Real-World Example: The Westlake Hills Early Retirees

I recently worked with a couple in Westlake Hills with $6.5 million in combined assets who wanted to retire at age 55—well before traditional retirement age.

We helped them build a retirement income strategy based on the bucket planning approach above, and also built in tax efficiency:

- Taxable account withdrawals covered the early retirement years to avoid triggering high tax rates on retirement account distributions

- Roth conversions were executed annually between ages 55-65 while they were in lower tax brackets

- Social Security was deferred to age 70 to maximize lifetime benefit

- Medicare IRMAA brackets were carefully managed to avoid premium surcharges [IRMAA BLOG]

By coordinating these moves, we lowered their projected lifetime tax liability by over $300,000.

Even more importantly, we gave them peace of mind that their retirement is sustainable—even under less-than-ideal market conditions. Our Monte Carlo simulations showed a 96% probability of success, even assuming higher inflation and below-average market returns.

Bottom line: Retirement planning for the affluent requires integration of investment strategy, tax planning, and distribution sequencing that goes far beyond the basics.

- Risk Management: Protecting What You’ve Built

The more wealth you accumulate, the more exposed you become to financial threats. It’s not just market risk—it’s lawsuits, liability tied to real estate or business, and unexpected events that can put your assets at risk.

That’s why risk management isn’t just about insurance. It’s about comprehensive asset protection.

The Vulnerability of Wealth

Here’s what many affluent families don’t realize: As your net worth grows, you become a more attractive target for lawsuits and claims. A fender bender that might result in a small claim for most people could turn into a “deep pockets” case if the other party discovers you have substantial assets.

At our firm, we help high-net-worth families proactively guard what they’ve built through multiple layers of protection.

Comprehensive Risk Management Framework

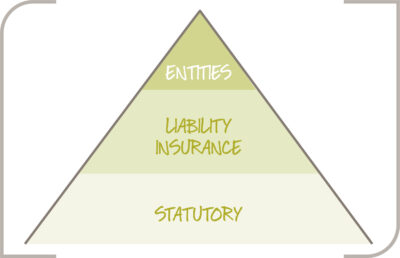

The Protection Pyramid shows how different strategies work together:

| Protection Layer | Tools | What It Protects Against |

|---|---|---|

| Foundation: Insurance | Umbrella liability (typically $5M-$20M), Specialty policies for collections/art | collections/art Basic claims, Standard liability |

| Middle: Asset Titling | LLCs for rental properties, Tenancy by entirety | Liability isolation, Creditor claims |

| Top: Family Limited Partnerships | Domestic asset protection trusts, Offshore trusts | Extraordinary claims, Business risks |

Case Study: The Physician’s Protection Plan

We worked with a physician client who had $15M in net worth and growing liability exposure from both his practice and personal investments. Here’s what we implemented:

- A $10M umbrella policy layered over his home, auto, and watercraft coverage

- Ownership of rental properties moved to three separate LLCs to segment and contain risk

- A second-to-die life insurance policy held in an ILIT to fund estate tax liability

- All household employees covered under employment practices liability insurance

This comprehensive approach ensures that even in a worst-case legal scenario, his family’s lifestyle and legacy remain intact.

Bottom line: Risk planning is not one-size-fits-all. As your assets grow, your protection strategy must evolve to match the scale of your success.

- Estate Planning: Beyond Basic Wills and Trusts

Without a thoughtful estate plan, your wealth is vulnerable to erosion from estate taxes, probate delays, and unintended distribution. For high-net-worth families, basic wills and trusts are just the starting point.

The federal estate tax exemption is currently $13.61 million per person (2024), but is scheduled to be cut in half in 2026. For many affluent Austin families, this creates an urgent planning window.

Estate Planning Goals for High-Net-Worth Families

The primary objectives we help clients achieve are:

- Reduce the taxable estate using advanced gifting strategies

- Freeze asset values to shift future appreciation to heirs

- Protect inheritances from divorce, lawsuits, and creditors

- Maximize control and clarity through coordinated titling and beneficiary designations

Advanced Estate Planning Tools: Beyond the Basics

| Strategy | How It Works | Best For |

|---|---|---|

| Spousal Lifetime Access Trust (SLAT) | Each spouse creates an irrevocable trust for the other, removing assets from estate while maintaining indirect access | Couples wanting to use exemption amounts while preserving access |

| Grantor Retained Annuity Trust (GRAT) | Transfer assets to trust, receive annuity payments, future growth passes to heirs tax-free | High-net-worth families with appreciating assets |

| Family Limited Partnership (FLP) | Consolidate assets under one entity, apply valuation discounts when transferring interests | Business owners and real estate investors |

| Dynasty Trust | Create a trust that can last for generations in states with favorable rules | Ultra-high-net-worth families focused on multi-generational planning |

Real Example: $40M Estate, $12M Tax Saved

I worked with a family with $40 million in total net worth including significant real estate holdings, marketable securities, and a private business. Over several years, we implemented:

- Lifetime gifts to grantor trusts for their children and grandchildren

- An FLP to transfer non-controlling interests in real estate at discounted values

- A $5M life insurance policy held in an ILIT to cover projected estate taxes

- A donor-advised fund funded with $1.5M in appreciated stock to fulfill philanthropic goals

The result? More than $12 million in projected estate tax savings—and just as importantly, a clear roadmap for transferring wealth that the heirs understand and support.

Bottom line: Estate planning isn’t just about documents—it’s about strategies that protect your wealth from taxation and ensure your legacy lasts generations.

- Philanthropic Planning: Strategic Giving

If charitable giving is important to you, choosing the right structure can help you achieve far more than just a tax deduction. At higher levels of wealth, philanthropy becomes a strategic tool that serves both your personal values and broader planning goals.

Charitable Vehicles for Different Goals

Each philanthropic vehicle serves different purposes:

| Charitable Vehicle | Initial Funding | Control Level | Complexity | Best For |

|---|---|---|---|---|

| Donor-Advised Fund (DAF) | $25,000+ typically | Medium | Low | Simplicity, immediate deduction, family involvement |

| Charitable Remainder Trust (CRT) | $250,000+ typically | High | Medium | Income retention, substantial appreciated assets |

| Private Foundation | $1M+ recommended | Highest | High | Family legacy, direct control, naming rights |

Donor-Advised Funds: Simplicity with Impact

DAFs are one of the simplest and most flexible tools for charitable giving:

- You contribute appreciated assets (like stocks) to the DAF, avoiding capital gains tax

- You receive an immediate tax deduction for the full fair market value of the gift

- The assets grow tax-free inside the DAF

- You recommend grants to your favorite charities at any time

DAFs are especially useful in high-income years (like after selling a business) and allow you to involve your family in annual giving decisions.

Charitable Remainder Trusts: Income + Impact

CRTs are ideal when you want to:

- Donate a highly appreciated asset

- Retain income for yourself or a beneficiary

- Leave the remainder to charity

Here’s how it works:

- You transfer the asset to the CRT

- The trust sells the asset without immediate capital gains tax

- The trust pays you an income stream for life or a term of years

- Whatever remains goes to the charity at the end

This strategy offers income tax deductions, defers capital gains, and reduces estate tax exposure while providing lifetime income.

Case Study: Tech Executive’s Charitable Strategy

An Austin tech executive with a significant position in company stock wanted to reduce tax exposure while supporting education initiatives. We developed a plan to:

- Fund a donor-advised fund with $1M of appreciated stock before selling his company

- Establish a charitable remainder trust with another $2M of stock that would provide income for 20 years

- Create a giving plan that would support ten local education nonprofits with structured, multi-year gifts

This strategy generated an immediate $1.7M tax deduction, eliminated approximately $450,000 in capital gains tax, and created a philanthropic legacy that will last decades.

Bottom line: Charitable strategies aren’t just about giving money away—they’re about reducing taxes, eliminating capital gains, and aligning your financial plan with your values.

- Business Succession Planning: Monetizing Your Life’s Work

If your wealth was built through a business, how and when you exit will define not only your financial future—but your family’s as well. For many Austin entrepreneurs, their business represents 70-80% of their net worth.

Monetizing that value effectively requires years of forward planning.

Exit Strategy Options for Business Owners

Different exit paths serve different goals:

| Exit Strategy | Timeline | Control Retention | Tax Efficiency | Best For |

|---|---|---|---|---|

| Family Succession | 3-10 years | High | Medium (with planning) | Businesses with interested, capable heirs |

| Management Buyout | 2-5 years | Medium declining to Low | Medium | Trusted management team with financing ability |

| ESOP | 3-7 years | High declining to Medium | Very High | Companies with strong management and stable cash flow |

| Strategic Sale | 1-3 years | Low | Low (without planning) | Maximizing value, clean break |

| Private Equity | 1-2 years | Medium (if rollover) | Medium | Growth-focused companies, partial liquidity |

Qualified Small Business Stock (QSBS): The Tax-Free Exit

One particularly powerful tool for business owners is the Qualified Small Business Stock (QSBS) exclusion under IRC Section 1202.

If your company qualifies, you can exclude up to $10 million in capital gains (or 10x your basis, whichever is greater) from federal taxes when you sell. That could save millions in capital gains tax.

To qualify:

- The business must be a C-corporation (not an S-corp or LLC)

- Gross assets must be under $50 million when stock was issued

- You must hold the stock for at least 5 years

- The business must be an active trade or business (not passive investments)

This strategy saved one of our clients $2.3 million in federal tax on a recent exit—highlighting the importance of planning your business structure years before a sale.

ESOPs: The Tax-Advantaged Succession Option

Employee Stock Ownership Plans (ESOPs) offer a compelling exit strategy that:

- Allows gradual transition while maintaining control

- Rewards employees and preserves company culture

- Provides substantial tax advantages

With an ESOP:

- The company creates a qualified retirement plan trust that buys stock from the owner

- The owner may defer capital gains under IRC Section 1042 if proceeds are reinvested in qualified securities

- The company repays the ESOP loan with tax-deductible contributions

This effectively uses pre-tax dollars to fund the buyout—a significant advantage over other exit structures.

The Strategic Advantage: Using ESOPs for Business Succession Planning

Bottom line: A business exit is likely the largest financial transaction of your life. Planning 3-5 years in advance can make a multi-million dollar difference in after-tax proceeds.

Bringing It All Together: The Integrated Wealth Plan

You don’t need 10 different advisors giving you 10 different answers. What you need is a team that speaks the same language across tax strategy, investment management, estate planning, risk mitigation, and legacy design.

Here’s what we covered today:

- Investment Management: Beyond the 60/40 portfolio to institutional-level strategies

- Tax Planning: Proactive strategies to minimize your largest expense

- Retirement Planning: Sophisticated bucket strategies for income and growth

- Risk Management: Multi-layered protection for your growing wealth

- Estate Planning: Advanced tools to minimize taxes and maximize control

- Philanthropic Planning: Strategic giving that balances tax benefits and impact

- Business Succession: Tax-efficient monetization of your life’s work

The key to success? Integration.

Each of these areas must work together as part of a unified strategy. The investment plan should support your retirement goals while minimizing taxes. The estate plan should align with your charitable intent. And business succession should feed into all of the above.

Is Your Current Plan Working? Ask These Questions

To determine if your current financial approach is appropriate for your wealth level, ask yourself:

- Does your advisor specialize in clients with similar net worth?

- Is your tax planning proactive or just reactive at tax time?

- Does your investment strategy incorporate alternatives appropriate for your wealth level?

- Is your estate plan updated for recent tax law changes and your current net worth?

- Do you have a documented family legacy plan beyond just legal documents?

If you answered “no” to any of these questions, it may be time for a more sophisticated approach.

Bottom Line

When your wealth reaches significant levels, financial planning isn’t just about growing money—it’s about optimizing a complex system of investments, entities, trusts, and tax strategies.

The strategies that worked during your wealth accumulation phase aren’t the same ones that will help you preserve, optimize, and transfer that wealth.

Working with a team that understands these dynamics isn’t a luxury—it’s a necessity to protect what you’ve built and ensure it serves your family for generations to come.

Because wealth doesn’t plan itself. But with the right team, it can support your goals for decades—and generations—to come.

Ready to take the next step?

Schedule a confidential consultation to evaluate your current plan and identify opportunities you might be missing.